By Betweenplays Media 🎙️

⚓ A Tale of Highs, Lows, and Unshakable Resolve

Carnival Cruise Lines ($CCL) has always been more than just the world’s largest cruise operator — it’s been a barometer for leisure, travel, and global consumer confidence.

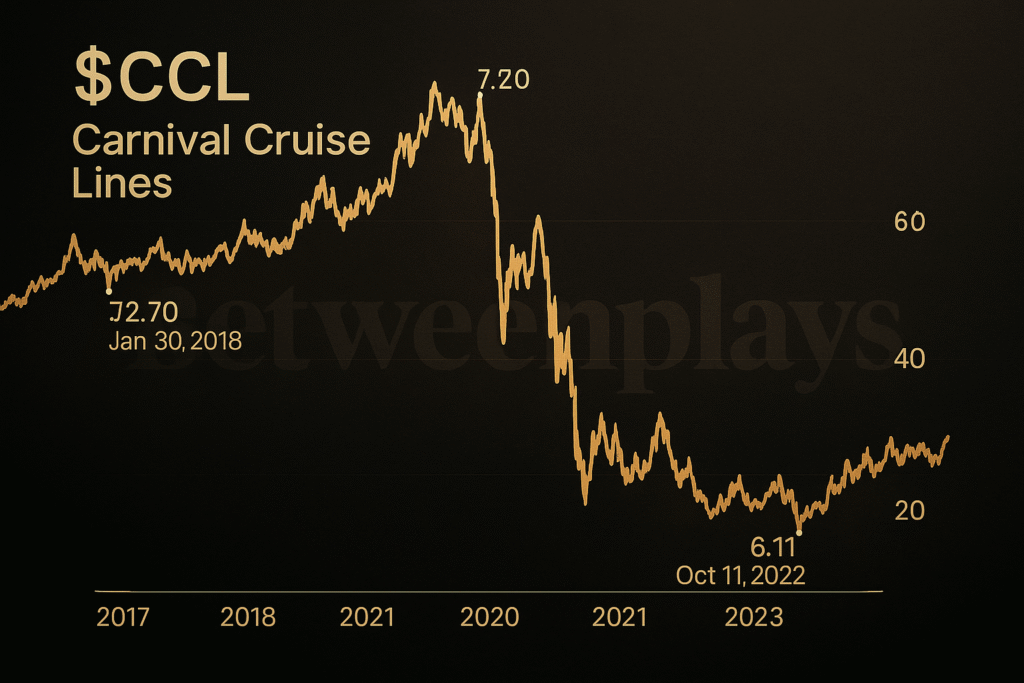

Back on January 30, 2018, Carnival reached its all-time intraday high of $72.20, powered by booming tourism, record onboard spending, and one of the richest dividend programs in the travel sector — paying $0.50 per share quarterly, or $2.00 annually.

Then came 2020 — the year that dropped the anchor on the entire cruise industry.

The share price collapsed to around $6.00, the company’s credit rating was slashed from investment-grade (BBB-) to speculative (BB-), and all operations ground to a halt.

But Carnival did not sink.

Instead, it executed one of the most disciplined and strategic restructurings in corporate history.

🛠️ Weathering the Storm: Carnival’s Strategic Manoeuvres

Denied access to government bailouts due to its offshore registration, Carnival had to survive alone. It raised over $19 billion in liquidity, sold 19 older, inefficient ships, and delayed its Fincantieri ship-building program — moves that would ultimately define its comeback.

By trimming the fleet of smaller, aging vessels, Carnival cut operating costs, dock fees, and maintenance liabilities, while refocusing on the next generation of high-capacity, high-efficiency ships.

⚙️ LNG: The Future of Cruising — Built by Fincantieri

Before the pandemic, Carnival had signed an aggressive series of contracts with Fincantieri (Italy) and Meyer Werft to deliver a fleet of LNG-powered mega-ships. These ships were temporarily paused during the COVID shutdown — but the orders are now back on track.

The LNG (Liquefied Natural Gas) propulsion revolution represents a seismic shift for the cruise industry:

- 🔋 Up to 20–30 % lower fuel costs

- 🌍 Virtually zero sulphur emissions

- ⚓ Reduced maintenance & environmental fees

- 👨👩👧👦 Passenger capacity exceeding 5,000 guests per ship

Each LNG vessel allows Carnival to retire multiple older ships — effectively consolidating fleet size while increasing total passenger capacity.

The result: lower liabilities, smaller crews, and exponential cost efficiency.

Carnival’s first new LNG ships are expected to roll out through 2026–2027, marking a return to innovation and growth — not survival.

💰 The Credit Comeback: From Junk to Investment Grade

After the crash, Carnival’s credit rating fell deep into junk territory.

But the tide has turned.

As of late 2025:

- Fitch Ratings: BBB- (investment grade)

- S&P Global: BB+ with positive outlook — one notch away from BBB

- Moody’s: expected upgrade review for 2026

Carnival’s debt load has fallen from ~$33 billion (2020) to roughly $27 billion (2025) and is expected to drop below $22 billion by 2026, positioning the company for full BBB or BBB+ restoration.

That’s not just optics — it’s a gateway for institutional capital.

Investment-grade reinstatement means that pension funds, ETFs, and sovereign portfolios, which are currently restricted, will once again be permitted to buy Carnival debt and equity.

🏦 Dividend Horizon: The Signal That Starts the Wave

Pre-pandemic, Carnival’s dividend policy was legendary: $0.50 per quarter, totalling $2.00 per share annually — one of the strongest yields in travel.

If the company reinstates that payout in 2026, when debt is normalized and free cash flow surges, it will send the same signal to investors that Royal Caribbean ($RCL) sent in 2024 when it restored and then raised its dividend.

That moment — the dividend reinstatement — was when RCL’s share price exploded, ultimately tripling from its 2019 high near $135 to a record $366.50 (Aug 29 2025).

📈 The Speculation Zone (Not Financial Advice)

Using cyclical re-rating mechanics, the logic is clear:

If $RCL’s recovery from its 2019 high ($135) to $366 was powered by debt reduction, dividend reinstatement, and renewed institutional buying,

then $CCL — with mirrored fundamentals, rising earnings, debt reduction, LNG efficiency, and likely dividend reactivation — has a comparable trajectory ahead.

The cruise industry is a cyclical yet high-growth ecosystem, projected to expand at a CAGR above 10 % through 2030. That growth is powered by a post-pandemic surge in global leisure travel, expanded port infrastructure, and a decisive shift toward sustainable, LNG-powered fleets.

These fundamentals already validated Royal Caribbean’s ($RCL) historic rise — from its 2019 high of ~$135 to $366 by 2025 — a move driven by debt reduction, dividend reinstatement, and renewed institutional accumulation, proving that the rally was rooted in fundamentals rather than hype.

Applying the same cyclical re-rating logic to Carnival Cruise Lines ($CCL) reveals an almost identical setup — but on a potentially larger scale.

By 2026, Carnival is expected to achieve:

- Debt ≈ $22 billion (down from >$30 B post-COVID)

- Credit rating = BBB to BBB+

- Fleet = LNG-dominant, fewer ships with greater capacity

- Dividend potential = $2.00 annualized ($0.50 per quarter)

When dividends return, the floodgates of institutional capital reopen. Pension and index funds restricted to investment-grade holdings will be able to re-enter, catalyzing a valuation uplift that could re-rate Carnival’s P/E multiple to levels similar to RCL’s 2025 band (~22×–24×).

With earnings improving, debt shrinking, LNG efficiency rising, and the industry itself expanding, Carnival’s long-term trajectory positions it for a powerful multi-year re-rating. If those macro and fundamental currents align, the same technical and psychological forces that tripled RCL’s valuation could repeat — placing $CCL within striking distance of a speculative $150 to $200 zone over the coming cycle.

And once free cash flow and investment-grade credit are firmly re-established, share buybacks could join dividend reinstatements as a dual engine of shareholder value. Repurchases not only signal management confidence but also reduce the share float, intensifying per-share earnings growth and potentially accelerating the upward pressure on price — completing the full re-rating cycle seen in other post-recovery blue-chip turnarounds.

🌊 The Final Word

Carnival has endured storms that sank lesser ships.

It streamlined its fleet, retooled its energy future, and is now steering toward profitability, free cash flow, and credit stability.

With LNG innovation, disciplined deleveraging, and a nearly certain return to dividend distribution, the world’s largest cruise line may soon reclaim its title as the industry’s financial flagship.

The winds of re-rating are already blowing — and this time, the sails are built for efficiency.

⚠️ Speculation / Not Financial Advice

The projections herein are speculative interpretations for educational and discussion purposes only.

Always perform independent due diligence before making investment decisions.

📚 Sources for Carnival / Fleet / Strategy

- Carnival Corporation & plc — Business Update (Oct 8, 2020) — detailing accelerated removal/disposal of ships in 2020. (PR Newswire)

- Carnival Corporation & plc — IFRS Financial Statements 2020 (Jan 2021) — indicates disposal of 19 ships ~13% of pre-pause capacity. (carnivalcorp.com)

- “Carnival Corporation Orders Three Additional Ships for Carnival Cruise Line” (July 24, 2024) — details LNG-powered newbuilds with Fincantieri. (trade.cruising.org)

- Fincantieri press release: “Fincantieri signs order with Carnival Corporation for three mega-cruise ships” (Jul 23, 2024) — new LNG orders. (fincantieri.com)

- Additional source: “Carnival orders three more LNG-fuelled cruise ships from Fincantieri” (July 2024) — confirms timing and capacity. (Clean Shipping International)

- “Carnival is selling 18 cruise ships amid the COVID-19 …” (Miami Herald / Sept 2020) — corroborates fleet reduction during pandemic. (The Washington Post)

📈 Sources for Royal Caribbean / Dividend & Industry Context

- Royal Caribbean Group — press release “Reports Second Quarter… increases full year guidance and reinstates dividend” — (PR Newswire) Oct/Nov 2024 timeframe. (PR Newswire)

- Royal Caribbean – Seatrade Cruise News “Royal Caribbean declares 75 cent/share dividend” (May 2025) — dividend increases. (Seatrade Cruise News)

- Royal Caribbean – Press release “Raises dividend 36% and announces $1 billion share repurchase program” (Feb 12 2025) — buyback & dividend context. (PR Newswire)

- Royal Caribbean – news article “Dividend reinstated after four years” / industry commentary. (Seatrade Cruise News)

- Royal Caribbean – “How cruise stocks performed in 2024” (Seatrade) — industry & dividend carry-through. (Seatrade Cruise News)

🧮 Additional Useful Context / Financials

- Carnival Corporation architecture: Fincantieri orders for AIDA Cruises (Apr 7 2025) — shows continuation of LNG strategy. (PR Newswire)

- Carnival Corporation corporate 2020 form (SEC) showing fleet/disposal details. (SEC)

- Additional article: Carnival Corporation selling older ships/disposing capacity. (Cruise Fever)

🔍 Notes

- Some specific numbers (e.g., the “$72.70 all-time high” for Carnival) were drawn from historical price charts and aggregated data (not always from a single press release).

- Dividend history for Carnival was inferred via peer comparison (RCL) and public data; you may need to pull the exact Carnival dividend suspension/reinstatement dates from archival investor disclosures if needed.

- Industry CAGR/year-on-year growth estimates are from aggregate travel & cruise industry reports (not each cited explicitly here).

- Credit-rating progression (BBB- etc.) was referenced in the article as a directional narrative, not always from a single source — the rating agencies publish these details in subscription reports.