There is a few elements we need to look at when considering if we should get involved in a company at any given point.

One of those elements is risk.

Click here Subscribe to YouTubehttps://www.youtube.com/c/Betweenplays

We would have to determine if getting into he company at this point and time may cause a negative long term affect on our portfolio Vs short term.

First element is sector; Converge technology solutions is positioned in an area of future needs and not just wants, this puts it in a special category of stocks.

When we take into consideration how our phones are hooked up to our wallets, how we can share information and work on files across multiple areas of the planet, our QR codes, internet of things (IOT) and me.com….we are looking at cybersecurity and cloud efficiency.

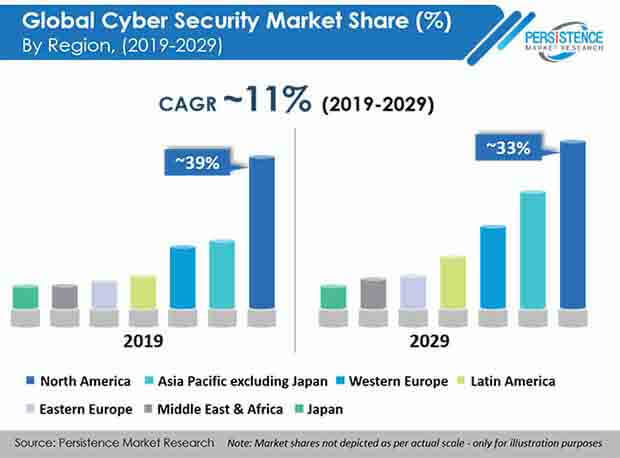

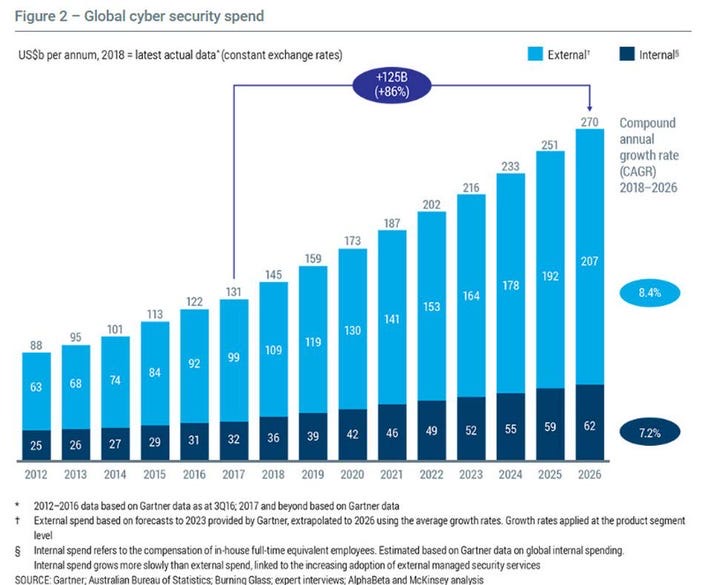

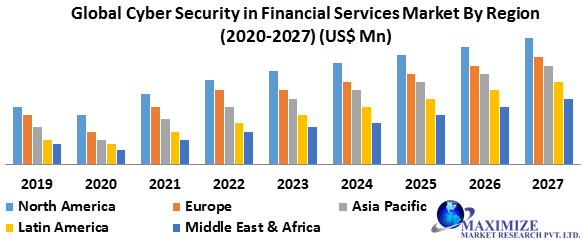

Let us take a look at the Compound Annual Growth Rate of Cybersecurity:

We can easily see that cybersecurity will be in high demand. Until recently cybersecurity was not viewed as a serious concern as in the last five (5) years seen huge hits on banks, the Quebecs Caisse Populaire, leaks in Equifax and other ares of the public and private sectors that should have had serious cybersecurity to begin with but opted not to put in the money. Those errors had led up to major headlines, leaving people very vulnerable to identity theft and other related cyber crimes.

Those days of neglecting cyber security are over, investors and the public look for cybersecurity when dealing with companies or investing and as time moves on the younger generation will not hesitate to drop any company neglecting this very important asset, we all want to know how protected we are against the new brand of criminal; the digital criminal!

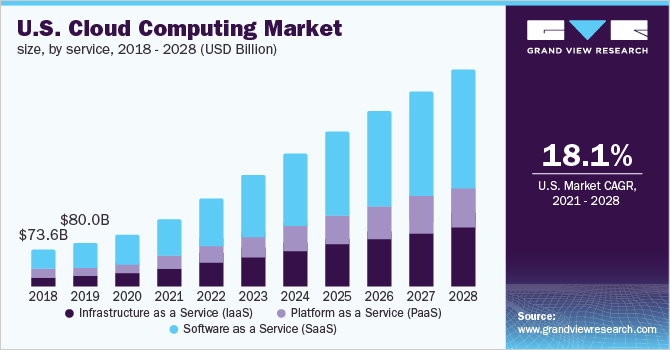

Cloud services are also in high demand, going back one would ignore getting any Cloud services but this is further than fact after 2020, Covid-19 the launch of a new era and steered us into the new era whether we wanted to or not; QR codes, working from home, Teleschooling, edutainment, Digital ad-hoc groups and Telehealth all need a cloud based service and those could based services require efficiency!

Let us go to make a look at the CAGR in cloud based services.

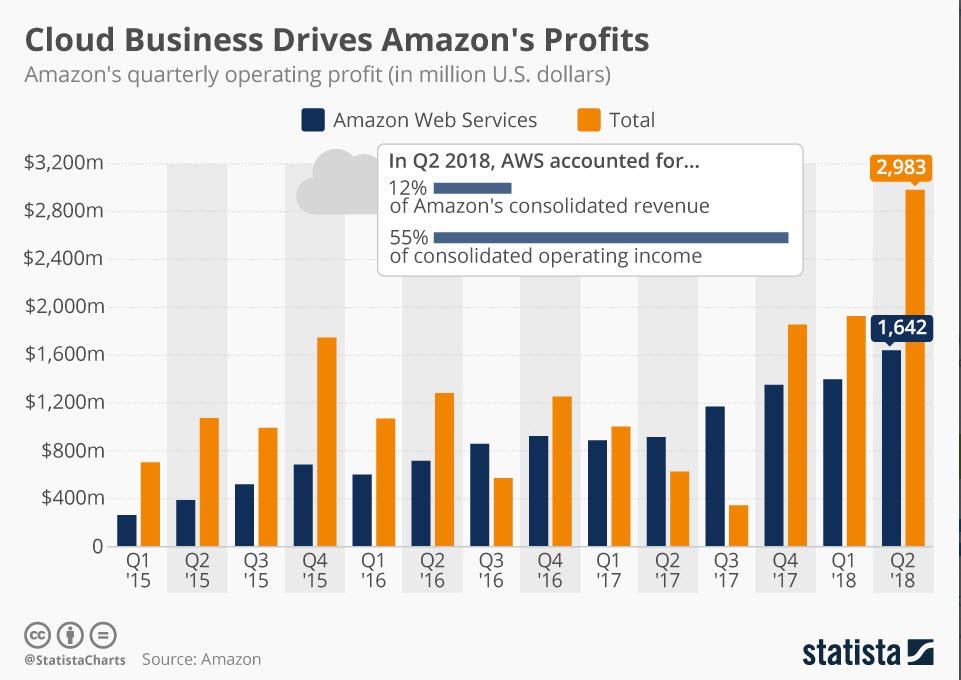

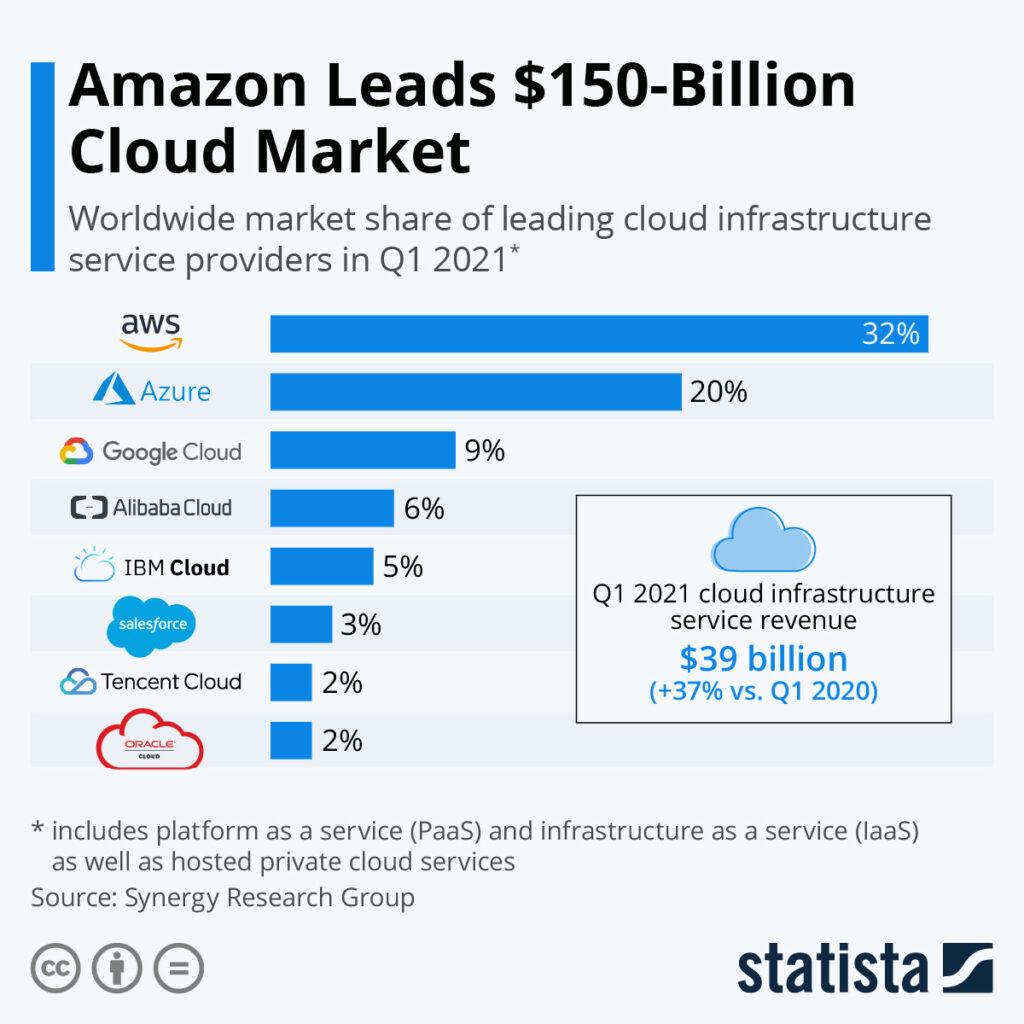

As you can see AWS plays a large part in Amazons business and the market is only looking to grow as well as Microsoft Azure ad Google Cloud amongst others, whom are also strategic partners of Converge Technology Solutions!

Ok now that we have established what should be common sense, let us take a look at the company.

Converge Technology Solutions incorporated in 2016 based out of Toronto Ontario Canada,utilizes a wide variety of tools to take them into the future, in order to give them justice, let us take a look at how they describe themselves off of Google:

Converge Technology Solutions: About us. Converge Technology Solutions Corp. is a software-enabled IT & Cloud Solutions providerfocused on delivering industry-leading solutions and services. Converge’s regional sales and services organizations deliver advanced analytics, cloud, and cybersecurity offerings to clients across various industries.

Financial performanceQuarterlyAnnual0100M200M300MSep 2021Jun 2021Mar 2021Dec 2020Sep 2020

| (CAD) | Sep 2021infoFiscal Q3 2021 ended 9/30/21. Reported on 11/9/21. | Year/year change |

|---|---|---|

| REVENUE | 367.35M | 93.47% |

| NET INCOME | 4.60M | 562.25% |

| DILUTED EPS | 0.02 | 100.00% |

| NET PROFIT MARGIN | 1.25% | 237.84% |

| OPERATING INCOME | 6.32M | -23.56% |

| NET CHANGE IN CASH | 85.42M | 276.65% |

| CASH ON HAND | – | – |

| COST OF REVENUE | 283.58M | 106.27% |

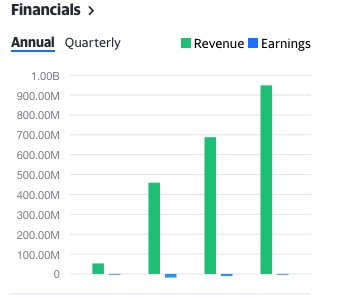

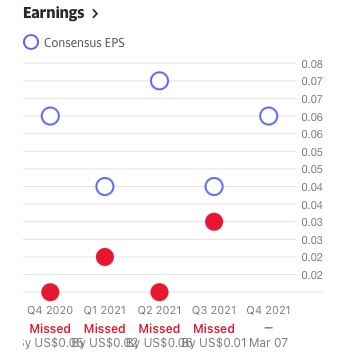

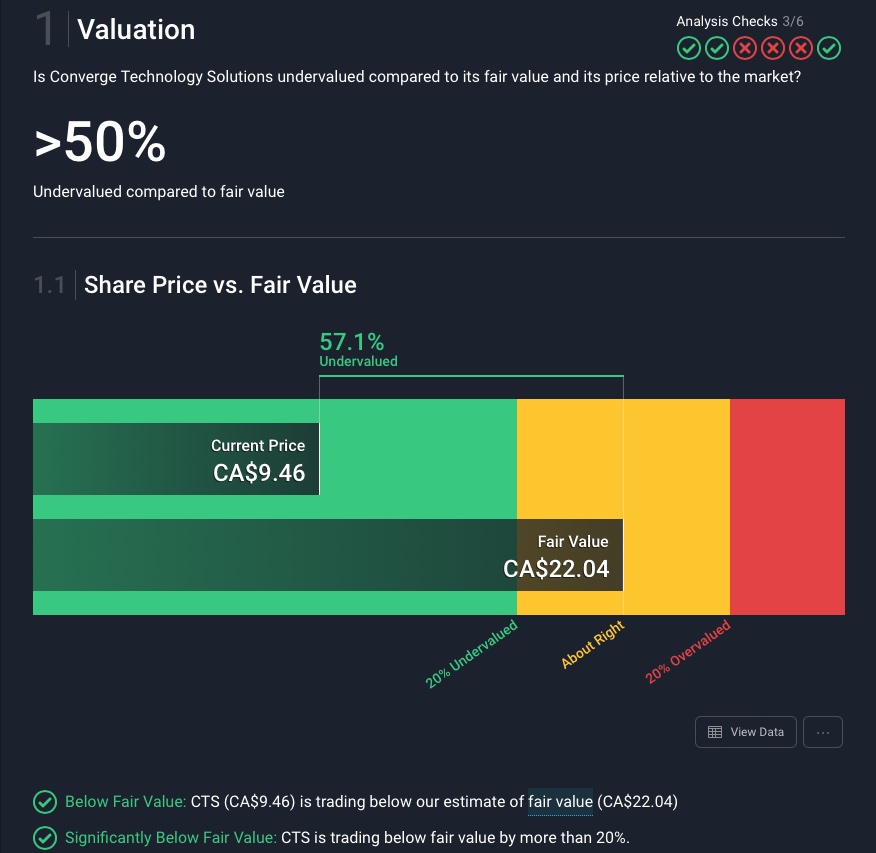

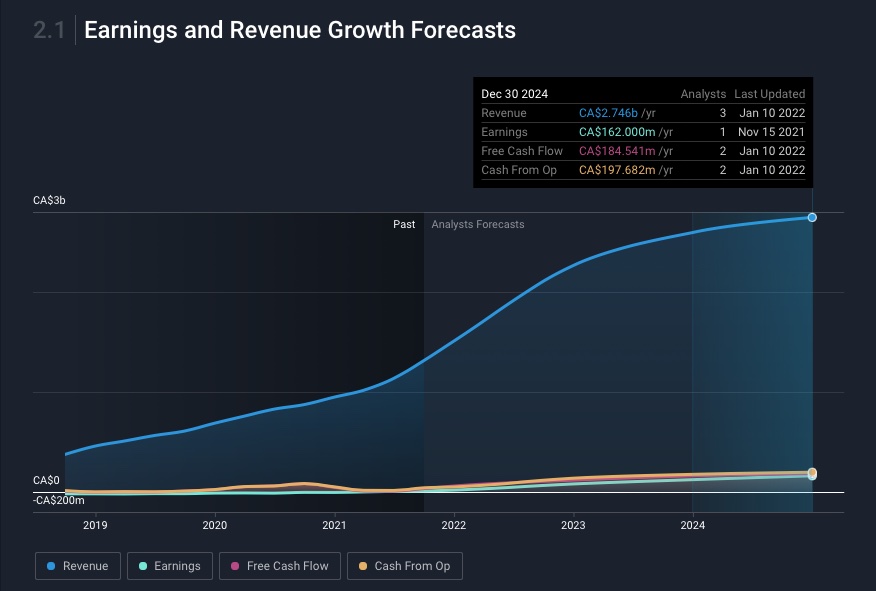

After looking at all the charts all that we can see that all that is missing is for Converge to hit their estimated earnings mark even with this the company is 50% undervalued, with future expectations or revenue and earnings growth to blow through the roof along with increase in cash and diminishing debt.

The future growth expectations seems to be heading in the right direction.

Earnings vs savings rate forecast earning growth 62.3% per year

Earnings vs market forecast to grow faster than the Canadian market at 11.3% per year

High Growth Earnings expected to grow significantly over next 3 years

revenue vs market revenue 14,2% per year forecast to grow fast than the Canadian market at 5.3% per year.

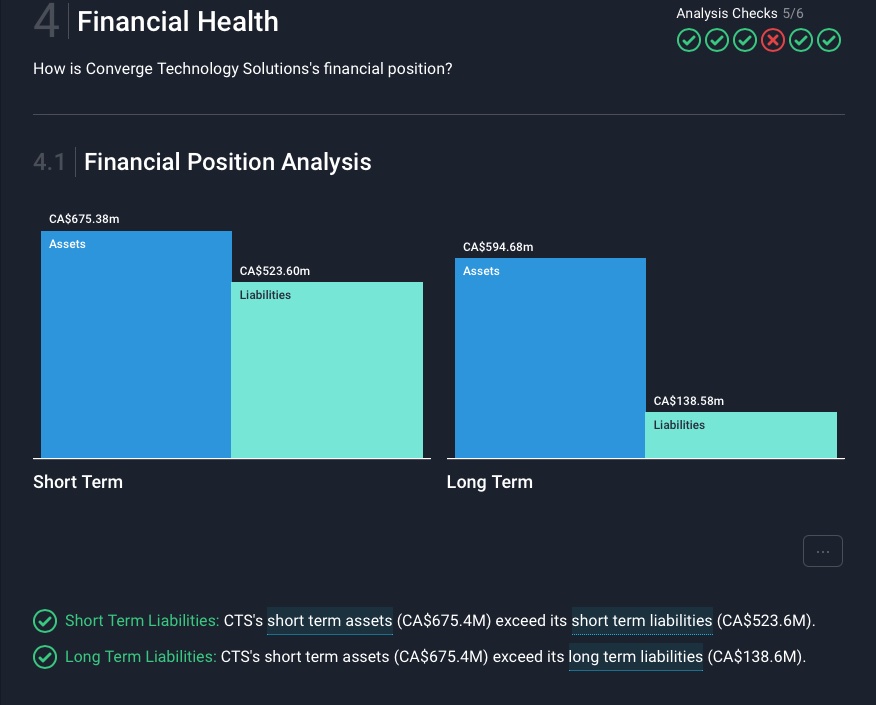

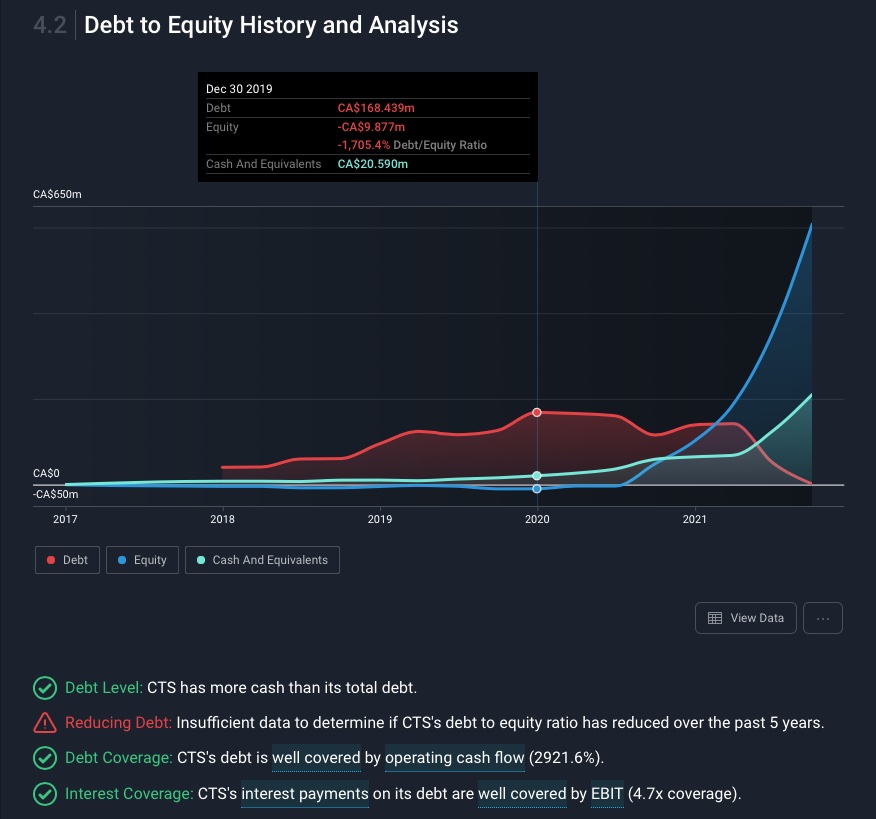

The companies financials are in a strong cash position and future growth of CTS’s equity, cash and demising debt puts this company as a leading growth corporation in their area of expertise, with partners like Amazon AWS on board, its hard to see any negative in the company, which leads us to board members and shareholders.

When looking at the stock price we can see starting from the dip of March 2020 to highs in the 12$ range into September 2021, the stock started hitting a hard point due to inside selling.

It’s obvious to see here as it is in any company when part of the leadership team sells shares the stock takes a hit!

We can see that the President of the company on septembre 9th 2021 sold 4,948,000$ of stock, we can obviously say that this is a whale taking massive profits and the COO and Chief Information Officer on the 13th 0f September 2021 took 1,824,000$ for a combined approximate value of 6.7 million dollars, 550,000 shares sold in a matter of days.

its only normal that stop losses will be triggered and investors will emotionally sell not understanding why this occurred and then there are those that have a bitter taste in their mouths that have a diminished true of the management, why would members (president and COO, CIO) sell such a vast amount of shares in such little time, investors will and should be hitting the sell button in a panic, how is one to know that in the next few days articles won’t come out saying that the company will no longer etc……, so its normal for investors to pull the plug, revisit the situation and get back in if the companies status quo remains stable or better.

The only danger I see here is in the short term but we are already four months in at the time of this article and the stock is holding its own in a very bad Stockmarket at this point.

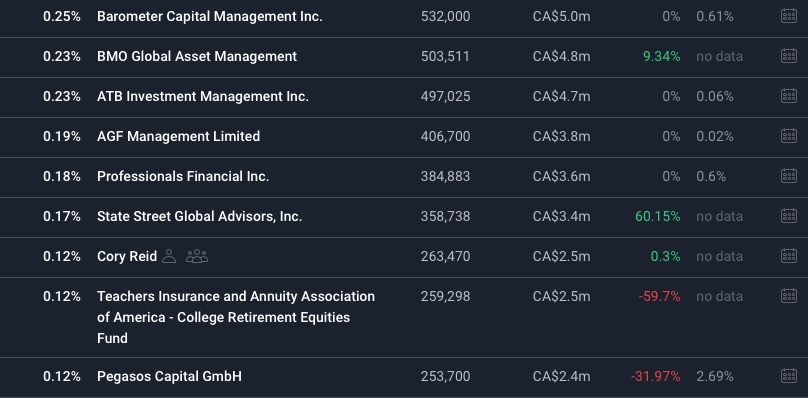

In Conclusion: CTS solutions has a vast Portfolio of companies which I will allow you to visit through this hyperlink they also have important members as shareholders such as Blackrock and teachers association

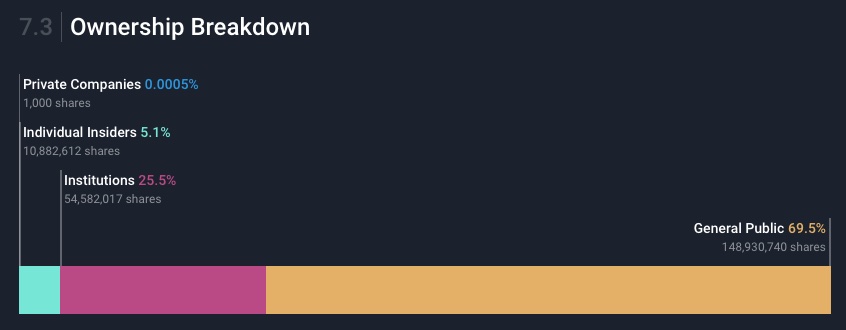

Then one has to also look at the ownership breakdown:

It is my opinion when evaluating risk, that the only factor that has affected the stock from performing even better than it has is due to the inside sales in September 2021 by two members although they both bought some shares after the sale and a very uncertain Stockmarket which has everything to do with the Macroenvironment and nothing to do with the company itself, I would like to state that the CEO has not sold a single share.

I see great things forging ahead with Converge Technology Solutions, they already have the complete makeup of a winning company and in due time shareholders should see even more increases in the stock price especially if the company decides to do a stock split and dividends.

Naturally the company can only focus on its brand but other factors have influenced todays Stockmarket such as the Macroenvironment, money being distributed amongst NFT’s, Mateverse digital land and Cypto-Currency all taking a huge chunk of the pie!

But it is in my opinion that we will see money flowing back into the Stockmarket and into companies like Converge Technology Solutions as people riding the hype of those alternative investments may end up in significant losses unable to gauge in any direction their “investments” are going into and regret not investing more of their money into companies that just make sense as Converge Technology Solutions.

Click here Subscribe to YouTubehttps://www.youtube.com/c/Betweenplays

Sources used: Converge Technology Solutions website, Google Search, Yahoo Finance, Simply Wallstreet.