By Betweenplays Media — August 10, 2025 (Montreal)

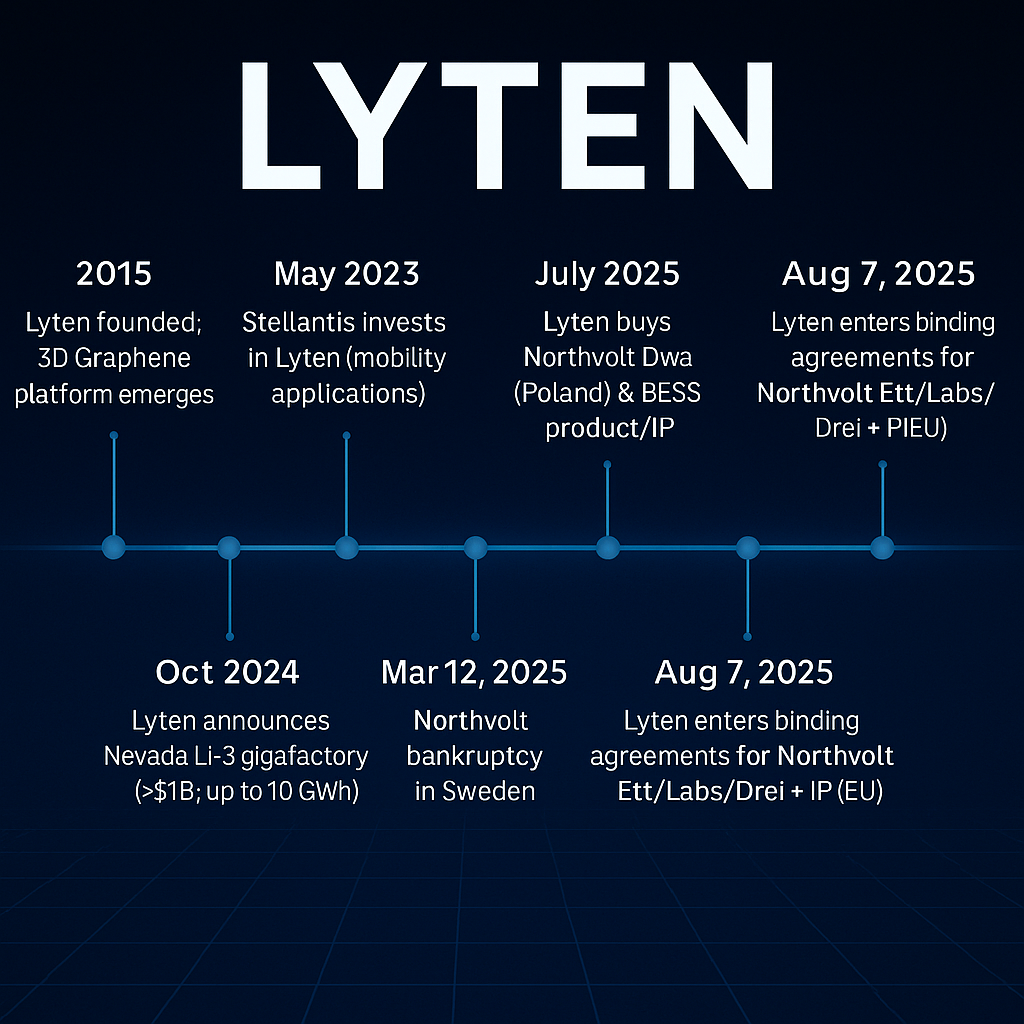

Lyten is a Silicon Valley battery and “supermaterials” company founded in 2015 by William Wraith Lars Herlitz, and Scott Mobley. It built a proprietary Lyten 3D Graphene™ platform and is commercializing lithium‑sulfur (Li‑S) batteries that aim to avoid nickel, cobalt, and (to a large extent) graphite — a supply‑chain and cost play as much as a technology bet. The company has raised hundreds of millions in equity, including Stellantis Ventures participation, and is planning a >$1B Li‑S gigafactory near Reno, Nevada (up to 10 GWh/yr) while standing up U.S. lithium‑metal foil production in San Jose to localize its anode supply chain. The strategy: vertically integrate critical materials + cell manufacturing across the U.S. and Europe, then scale into BESS/defense/space and, over time, automotive.

Back to Quebec: Lyten says it wants Northvolt Six

After entering binding agreements to acquire Northvolt’s remaining Sweden and Germany assets — Northvolt Ett & Ett Expansion (Skellefteå), Northvolt Labs (Västerås), and Northvolt Drei (Heide) — plus all remaining IP, Lyten publicly stated it is “committed to pursuing the acquisition” of the Northvolt Six complex in Quebec’s Montérégie region. The company says it’s in active talks with Northvolt North America, the Government of Canada, the Government of Québec, and local stakeholders.

The Quebec project — ~C$7 billion, between Saint‑Basile‑le‑Grand and McMasterville — had been pitched as a fully‑integrated cell + CAM + recycling site.

MESSAGE TO READER: On August 9th, 2024, a catastrophic backflow flood — triggered by extreme weather — inundated my home and studio with over 3½ feet of contaminated water. The disaster destroyed all broadcasting equipment, wiped out my HVAC system, and forced a full-scale demolition and sterilization of the basement. The rebuild required months of intense, hands-on labor, further complicated by a serious inguinal hernia caused by the physical strain of recovery work, which later required surgery.

Despite the loss of a year of production for Betweenplays Media, the crisis became a period of behind-the-scenes rebuilding — upgrading the studio, mastering new editing skills, expanding professional networks, and re-strategizing content direction.

Now, in September 2025, the payoff is here: interview requests are piling up, high-profile opportunities are lining up back-to-back, and the platform is entering a sustained growth phase. What began as a nightmare has become the foundation for the strongest relaunch in the brand’s history.

Quebec Economy Minister Christine Fréchette posted that the province will meet Lyten to hear “what they have to offer,” stressing Quebec has “leverage to regulate or refuse” any sale and will “rigorously assess” the situation. Karen Chang, interim CEO of Northvolt North America, called Lyten’s interest encouraging for Quebec’s role in the North American battery ecosystem. (Canadian Press reporting)

This follows Northvolt’s bankruptcy filing in Sweden on March 12, 2025, one of the country’s largest industrial failures, after months of strain and a scramble for buyers.

Public money at risk. Before the bankruptcy, Quebec invested C$270 million in Northvolt’s Swedish parent, while the Caisse de dépôt et placement du Québec (CDPQ) put in ~C$200 million.

What Lyten already bought in Europe — and why that matters to Quebec

Scope of the deal (EU): Lyten’s agreements cover Northvolt Ett/Ett Expansion, Labs, Drei, and IP. Swedish Deputy PM Ebba Busch praised the move as helping Europe’s energy independence; Lyten says it will restart Skellefteå and Västerås quickly and re‑hire a significant portion of laid‑off staff. Target: resume cell deliveries in 2026 (for Sweden). Pricing wasn’t disclosed; Reuters reports Lyten bought at a “substantial discount” to the original asset value.

Pre‑deal runway: In November 2024, Lyten acquired Northvolt’s Cuberg facility in California; in July 2025 it also acquired Northvolt’s Dwa BESS plant in Gdańsk, Poland (Europe’s largest) and Northvolt’s BESS product/IP portfolio — indicating an intention to lead energy storage, not just EV cells.

If Quebec clears: Adding Northvolt Six (QC) would give Lyten a tri‑continental footprint (U.S. West, EU North/Central, Eastern Canada) powered by low‑cost hydro and close to U.S. customers — all aligned with “local content” and national‑security incentives emerging across the West.

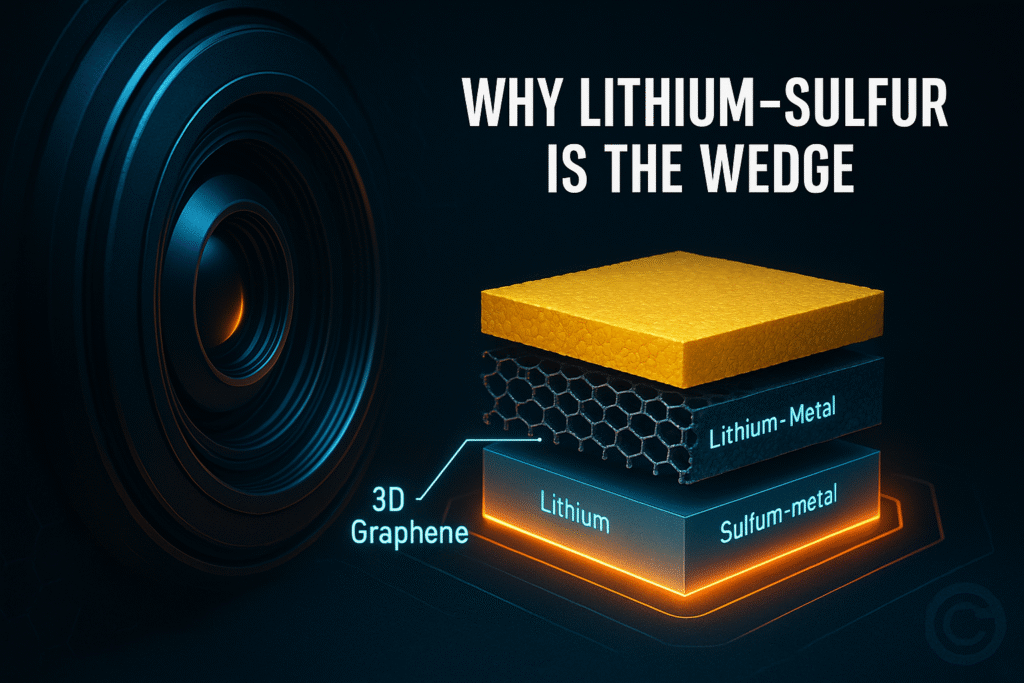

Technology lens: Why lithium‑sulfur is the wedge

What’s different? Li‑S targets higher specific energy and lower cost by swapping NMC/LFP cathodes for sulfur (abundant, low‑cost) and a lithium‑metal anode. The potential: lighter packs and reduced reliance on constrained minerals. The trade‑offs are cycle life (polysulfides/shuttle), safety management, and manufacturing maturity. Lyten argues its 3D Graphene structures stabilize the chemistry and enable manufacturability; independent reporting underscores Li‑S’s promise if durability hurdles are solved at scale.

Localization push. Lyten’s move to produce battery‑grade lithium‑metal foil domestically (San Jose) is notable — an anode bottleneck most newcomers outsource — and fits its Nevada gigafactory plan (cell, cathode, and anode in one country).

Quebec stakeholders: What changes if Lyten takes the keys?

- Project continuity vs. reset. Lyten says it tends to “pick up where the Northvolt team left off.” For Quebec, that could mean reuse of site engineering and utilities, but likely a chemistry/process shift to Li‑S over time. Timelines will hinge on regulatory diligence and what Lyten chooses to build first (BESS vs. EV).

- Public‑interest tests. Expect Ottawa/Quebec to evaluate national‑security, IP, jobs, and supply‑chain outcomes in any sale approval. Minister Fréchette’s “leverage to regulate or refuse” sets the tone.

- Grid‑first economics. Lyten’s recent buys in BESS (Poland + product/IP) suggest near‑term focus on stationary storage, where cycle‑life demands can be matched to use‑cases and the market is exploding globally. Quebec’s low‑cost hydro and interties into Northeast U.S. markets are strategic for BESS assembly and export.

Investor view: Who benefits (and how to think about it)

Important note: Lyten is private. There is no direct equity avenue at this time. Exposure, therefore, comes through partners, customers, suppliers, and themes. None of the following is financial advice; do your own research.

A) Strategic investors with a line into Lyten

- Stellantis (NYSE: STLA) — The automaker’s venture arm invested in Lyten to accelerate Li‑S and 3D‑Graphene applications for mobility. If Lyten executes, Stellantis could gain preferential access/insight to the tech for future EV programs or lightweighting/sensing.

- FedEx (NYSE: FDX) — Identified by Reuters as a Lyten backer; near‑term applications could be aviation/ground logistics, drones, or depot‑level BESS for fleet charging — adjacencies where weight and energy density matter.

How to use: Track corporate disclosures for pilots, purchase agreements, or tech evaluations referencing lithium‑sulfur or Lyten on earnings calls or 8‑Ks. Early BESS deals could show up before EV.

B) Former Northvolt counterparties — optionality if operations restart

- Legacy auto names once tied to Northvolt (e.g., Volkswagen Group/Scania, BMW) have not committed to Lyten. Reuters quotes Scania’s ventures lead as “too early to say.” If Lyten stabilizes yield/quality and offers a local‑content path, RFPs could re‑open. Treat this as watchlist, not a thesis.

C) Thematic & regional spillovers (Quebec)

- Construction/engineering & utilities around Montérégie can benefit from site activation regardless of chemistry. These are second‑order effects and require contract‑level confirmation before forming an investment view. (We’ll flag named contractors once award notices become public.) No position implied.

D) Risk checklist for investors

- Regulatory risk (Canada/EU). The EU transactions still require approvals; the Quebec acquisition would face provincial/federal review. Deal terms could include commitments on jobs, capex, or IP.

- Execution risk. Reuters reports Skellefteå deliveries targeted for 2026; that assumes fast rehiring, supply qualification, and capex. Li‑S commercialization at EV scale remains unproven sector‑wide; BESS may lead.

- Capital intensity. Nevada alone is >$1B; European restarts and a Quebec build would add to funding needs (even if asset prices were acquired at a discount).

- Bankruptcy hangover. Sweden’s trustee has warned creditors face significant losses; unwinding claims and contracts can slow integrations.

What exactly did the Canadian Press report?

- Lyten wants Quebec’s Northvolt Six after agreeing to purchase Northvolt Ett/Ett Expansion, Labs, Drei and the remaining IP in Europe.

- Value undisclosed.

- Quebec’s $7B factory is slated for Saint‑Basile‑le‑Grand/McMasterville; Lyten says it is actively progressing discussions with Ottawa/Quebec and stakeholders.

- Minister Fréchette: government will meet Lyten; province has leverage to regulate or refuse.

- Northvolt NA interim CEO Karen Chang: Lyten’s interest underscores Quebec’s ecosystem potential.

- Public exposure: C$270M (Quebec) + ~C$200M (CDPQ) invested pre‑bankruptcy.

Timeline snapshot

Bottom line

Lyten is executing a two‑continent roll‑up + build‑out: buy stranded best‑in‑class assets in Europe, stand up localized materials and gigafactory capacity in the U.S., and — if Quebec clears — stitch Canada into a North American Li‑S/BESS supply chain. The upside case is local, tariff‑resilient batteries with lighter chemistries for drones, defense, BESS, and eventually EVs. The bear case is execution/regulatory drag and chemistry scale‑up risk. For now, the public‑market proxy is watching STLA (strategic investor) and FDX (identified backer) for concrete pilots and purchase agreements, while monitoring Ottawa/Quebec on the Northvolt Six file.

Sources & further reading

- Business Wire (Aug 7, 2025) — Lyten to Acquire All Remaining Northvolt Assets in Sweden and Germany

↳ Read more Newswire+15Lyten+15northvolt.com+15 - Reuters (Aug 7–8, 2025) — Lyten buying most of Northvolt; 2026 restart target; creditor losses context

↳ Read more Reuters+10Reuters+10Reuters+10 - The Canadian Press (Aug 8, 2025) — Lyten interested in purchasing Northvolt battery plant in Quebec; minister & CEO quotes; public exposure figures

↳ Read more northvolt.com+15Yahoo Finance+15Coast Reporter+15 - Northvolt (Mar 12, 2025) — Official bankruptcy announcement in Sweden

↳ Read more Bloomberg+15Newswire+15Reuters+15 - CDPQ (Nov 2023) — C$200M investment in Northvolt

↳ Read more northvolt.com+15ai-cio.com+15Coast Reporter+15 - Lyten Corporate Pages — About / 3D Graphene; Nevada gigafactory; lithium-metal foil production

↳ Nevada Gigafactory graphene-info.com+8Lyten+8Lyten+8Yahoo Finance+10Lyten+10Lyten+10

↳ U.S. lithium‑metal foil production Lyten+2Lyten+2 - Reuters (Oct 15, 2024) — Nevada gigafactory plan: investment >US$1B, up to 10 GWh capacity

↳ Read more graphene-info.com+2blog.traqo.io+2graphene-info.com+6Reuters+6Yahoo Finance+6 - Government of Canada (Sep 28, 2023) — PMO announcement: Northvolt Six project — Saint-Basile-le-Grand / McMasterville (C$7B battery facility)

↳ Read more greencarcongress.com+15Prime Minister Canada+15MINING.COM+15

Disclaimer – Betweenplays Media

Betweenplays Media is a content-driven platform, delivering market insights, technology coverage, and geopolitical analysis for informational and educational purposes only. The views expressed are those of the authors and guests, based on publicly available information, personal analysis, and opinion. Nothing in this publication should be interpreted as investment advice, financial recommendations, or a solicitation to buy or sell any security. Always conduct your own research or consult a qualified financial professional before making any investment decisions. Betweenplays Media assumes no liability for any loss or damages arising from the use of this information.

-

The Great AI Decoupling: Beyond the Nuclear Band-Aid to the Era of Sustainable Intelligence

AI is not just a software wave; it is a thermodynamic event. As model scale and inference volume explode, the constraints are no longer GPUs and talent—they are megawatts, cooling […]

-

The Data Heist Game: Quantum is Coming

Harvest Now, Decrypt Later (HNDL) is Already Here For decades, encryption has given us a comforting illusion. Once data is encrypted and stored, it is safe. Not just today, but […]

-

FREEFALL: How One Neutron Could Have Brought Down an Airbus (Maybe), and Why Telecom Never Felt a Thing

A Betweenplays Media Inc. Editorial FeatureBy COO & Editor-in-Chief Sandeep Panesar WHEN A STAR INTERRUPTS A FLIGHT PATH — THE FREEFALL On October 30th, 2025, a JetBlue Airways Airbus A320 […]