- Nortel Networks: The Rise, Frenzy, Fall, and the Shadow of Corporate Espionage

Nortel Networks: The Rise, Frenzy, Fall, and the Shadow of Corporate Espionage

Nortel Networks was the crown jewel of Canadian innovation, shaping global telecom with digital switching, optical networking, and wireless infrastructure but corporate espionage played a major factor to its demise. By July 2000, Nortel’s share price touched C$124.50 and its market value neared C$398 billion — more than one-third of the TSX. Less than a decade later, it was in bankruptcy. This exposé covers the Bay Networks gamble, dot-com market frenzy (including sell-side amplification), executive missteps, the breakup and patent windfall, investor and political fallout, and the long arc of cyber espionage allegations.

The Rise

Born from Northern Electric and powered by Bell Northern Research (BNR), Nortel pioneered digital PBX (SL-1) and DMS switching, then surged into optical networking. By the 1990s, Nortel was supplying networks to carriers worldwide and defining industry standards. By doing so they were able to control infrastructure decisions with the majority of the manufacturing houses. They were a threat out of the gate.

In the mean time

Across the street Blackberry (another Canadian jewel) sought to revolutionize mobile communications by combining telephony, Email and data wirelessly. This was another revolution that we still depend on today that was ill fated.

The Bay Networks Gamble (1998)

In 1998 CEO John Roth acquired Bay Networks for ~US$9.1B in stock to fuse telecom and enterprise networking. Integration proved difficult: cultures clashed, overlapping products lingered, and lawsuits followed. The acquisition became a cautionary tale about overpaying for expansion without clear post-merger strategy. This was in theory a sound strategy however Nortel’s inability to successfully integrate Bay Networks was likely the last nail in NN’s coffin. Poor management and an inability to amalgamate the two organizations would be their death knell…perhaps.

Market Frenzy → Collapse

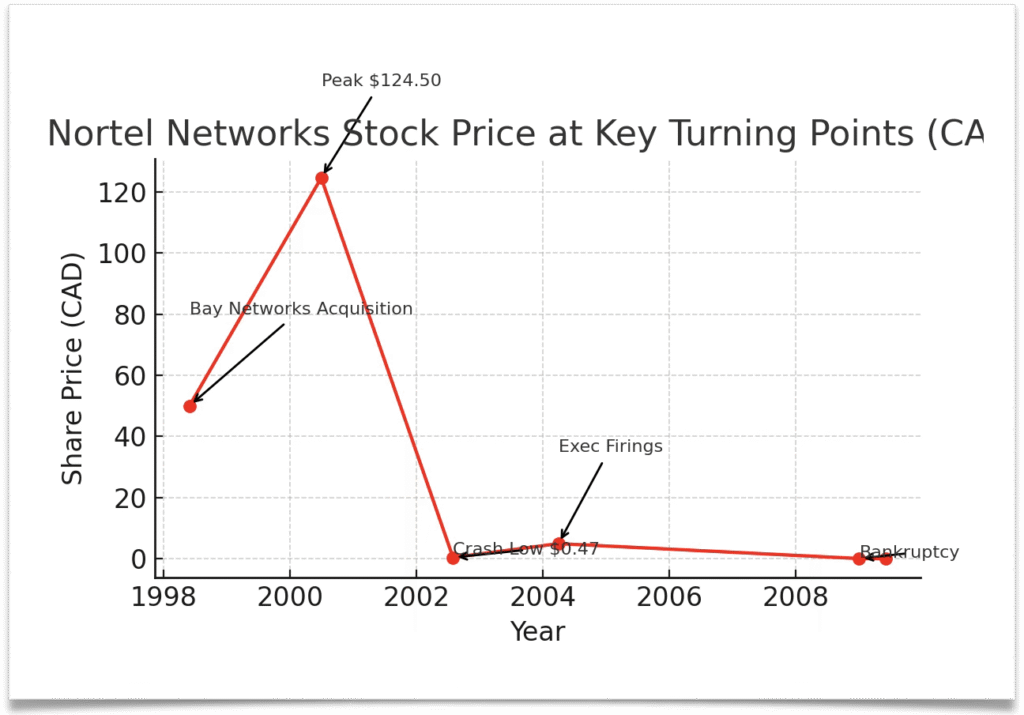

Nortel’s shares soared to C$124.50 in July 2000 before crashing to C$0.47 in August 2002. During the bubble, bullish sell-side research and underwriting activity amplified momentum, creating a “must-own” narrative across Canadian funds and pensions. When the dot-com bubble burst, Nortel’s heavy reliance on carrier capital expenditures left it overexposed. Over networked, too much fibre in the ground, and not enough demand.

Major Turning Points: Bay Networks deal (1998), Stock Peak (2000), Stock Crash (2002), Executive Firings (2004), Bankruptcy (2009)

Executive Timeline & Missteps

Leadership was a challenge. The company was pushing hard to rapidly expand and acquire. They were our country’s darlings, and yet misstep after misstep whether through arrogance or incompetence it was there for the world to see:

- John Roth (CEO, 1997–2001): Bay Networks acquisition; rapid expansion; integration gaps.

- Terry Hungle (CFO, until 2002): Retirement-account timing controversy damaged public trust.

- Frank Dunn (CEO, 2001–2004): Aggressive accounting; fired for cause; charges later dropped.

- Mike Zafirovski (CEO, 2005–2009): Restructuring attempts; bankruptcy filing (2009).

Bankruptcy & Asset Sales

Nortel filed for bankruptcy in January 2009. Assets sold included Wireless → Ericsson (US$1.13B), Enterprise → Avaya (~US$915M), Optical/Carrier Ethernet → Ciena (~US$774M), and Patents (6,000) → Rockstar Consortium (US$4.5B).

The company was gutted and left with no legs to stand on, however with all that money flowing around it’s hard to see how they went bankrupt if it wasn’t on purpose. This is simply the writer’s supposition based on the information gathered, though it does seem purposeful. So let’s dive a little deeper into what went on when Canada’s favorite company disappeared from the technology landscape.

MESSAGE TO READER: On August 9th, 2024, a catastrophic backflow flood — triggered by extreme weather — inundated my home and studio with over 3½ feet of contaminated water. The disaster destroyed all broadcasting equipment, wiped out my HVAC system, and forced a full-scale demolition and sterilization of the basement. The rebuild required months of intense, hands-on labor, further complicated by a serious inguinal hernia caused by the physical strain of recovery work, which later required surgery.

Despite the loss of a year of production for Betweenplays Media, the crisis became a period of behind-the-scenes rebuilding — upgrading the studio, mastering new editing skills, expanding professional networks, and re-strategizing content direction.

Now, in September 2025, the payoff is here: interview requests are piling up, high-profile opportunities are lining up back-to-back, and the platform is entering a sustained growth phase. What began as a nightmare has become the foundation for the strongest relaunch in the brand’s history.

Corporate Espionage Allegations & Huawei

Public reporting indicates Nortel suffered long-term intrusions (circa 2000–2009), with executive credentials and R&D data stolen. Huawei benefited indirectly through partnerships, hiring ex-Nortel engineers in Ottawa, and leveraging public telecom standards. These are facts, not accusations. Outside actors were involved in the collapse of NN. Unfortunately, none of that ever truly came to light, and we are still left to our own research and our own findings. People were hurt and their lives were impacted by Nortel’s demise.

Investor Impact

The collapse devastated retirees and investors. Nortel’s underfunded pension plan led to reduced benefits for many, while mutual funds and pensions overweight in Nortel suffered severe losses. Thousands of employees saw their retirement savings wiped out. Canadian politics has never forgiven what happened to Nortel’s 95000 employees worldwide.

Political Fallout

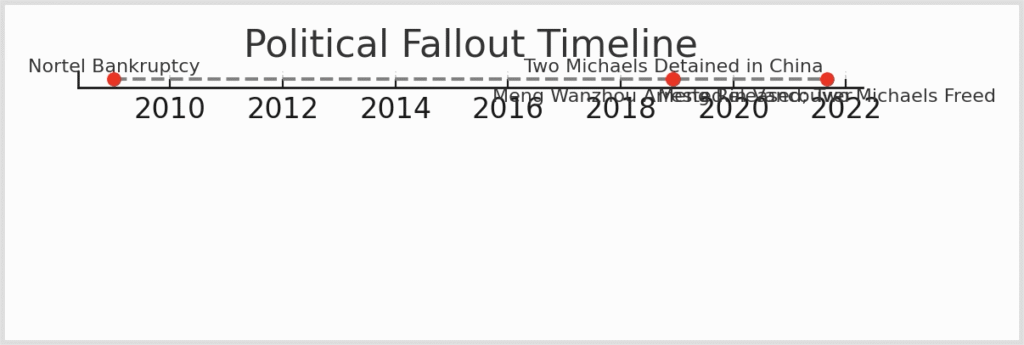

Nortel’s demise catalyzed debate on foreign investment rules, cybersecurity strategy, and pension protections. The patent sale to Rockstar and debates around industrial policy highlighted gaps in Canada’s approach to strategic tech assets. Nearly a decade later, those are still unresolved vulnerabilities, and Canada was pulled into stark relief when it was drawn directly into the geopolitical battle over technology dominance.

On December 1, 2018, Huawei’s Chief Financial Officer, Meng Wanzhou — daughter of Huawei founder Ren Zhengfei — was arrested in Vancouver at the request of U.S. authorities, accused of fraud involving violations of U.S. sanctions on Iran. The arrest triggered a diplomatic crisis. Within days, two Canadian citizens, Michael Kovrig and Michael Spavor, were detained in China in what was widely viewed as retaliation.

Former Prime Minister Justin Trudeau publicly emphasized Canada’s judicial independence, but the political cost was severe: trade tensions with China escalated, domestic criticism of Canada’s vulnerability in the tech supply chain grew louder, and allies scrutinized Canada’s role in U.S.-China relations. In September 2021, Meng reached a deferred prosecution agreement with the United States and was allowed to return to China — the same day Kovrig and Spavor were released. Interesting, no?

The parallels with Nortel’s fate were not lost on policymakers. In both cases, Canada found itself the arena where larger powers contested technological dominance. Nortel’s collapse had been a warning shot about the strategic importance of intellectual property and the dangers of foreign interference — but Meng’s arrest underscored that in the 21st century, corporate struggles and geopolitical maneuvering are inseparable.

So what have we learned if anything?

The social and political markets dominate everything. If you want to destroy something, you can. If you want to create something you can also do so. The facts of the matter are simple to understand and divisive to interact with:

• Market euphoria blinds: fundamentals beat hype.

• Integrate acquisitions or don’t do them.

• Ethics and optics matter.

• Protect IP; treat cyber risk as existential.

• National policy matters; avoid leaving champions exposed.

Now the Fun stuff Rockstar, Huawei, Apple, Microsoft, Ericsson, Blackberry, Sony, and HGGC.

After Nortel’s collapse, the Rockstar Consortium—comprised of Apple, Microsoft, Sony, BlackBerry, and Ericsson—purchased more than 6,000 patents from Nortel for US $4.5 billion in 2011. These patents covered core technologies in wireless, optical networking, and enterprise infrastructure (https://www.techinsights.com/blog/nortel-patents-make-news-again-rockstar-patents-sold-rpx, https://en.wikipedia.org/wiki/Rockstar_Consortium).

In 2013–2014, Rockstar launched multiple patent infringement lawsuits against key tech players including Google, Samsung, HTC, and Huawei (https://www.reuters.com/article/technology/google-samsung-huawei-sued-over-nortel-patents-idUSBRE99U1EN). These legal actions centered on patents related to search, advertising, interface navigation, messaging, and networking technologies.

By late 2014, Rockstar began winding down. It sold over 4,000 of its Nortel-derived patents to RPX Corporation, a defensive patent aggregator, for about US $900 million and ceased its litigation against several targeted defendants (https://appleinsider.com/articles/14/12/23/apple-backed-rockstar-consortium-to-shed-4000-patents-end-lawsuits-in-900m-deal). Huawei, which had faced litigation from Rockstar, reached a private settlement—leading to the dismissal of the lawsuit, though terms were not publicly disclosed. It is presumed the agreement included a licensing arrangement allowing Huawei continued use of those patents (https://www.macrumors.com/2014/01/23/huawei-settles-rockstar/).

This sequence illustrates how Nortel’s patent assets were not only monetized and restructured, but eventually filtered into broader industry ecosystems—including Huawei—through licensing post-litigation.

From Rockstar to RPX to HGGC: The Post-Nortel Patent Chain

After Nortel’s 2009 bankruptcy, its 6,000-patent portfolio became one of the most hotly contested technology assets in history. In 2011, the Rockstar Consortium—a partnership of Apple, Microsoft, Sony, BlackBerry, and Ericsson—acquired these patents for US $4.5 billion. The goal was to secure intellectual property leverage against mobile and telecom competitors, particularly Google, Samsung, HTC, and Huawei (Wikipedia – Rockstar Consortium).

Rockstar actively asserted these patents in litigation from 2013 to 2014, targeting Android ecosystem players. But as the legal battles dragged on, member companies opted for a more neutral exit strategy. In December 2014, Rockstar sold over 4,000 patents—including many from Nortel—to RPX Corporation for about US $900 million. RPX, a defensive patent aggregator, was tasked with neutralizing the litigation risk and licensing the portfolio across the industry (AppleInsider).

By acquiring the Rockstar assets, RPX effectively ended high-profile litigation with Huawei and other Android vendors, often via confidential licensing settlements. This moved the Nortel patents from an offensive litigation posture to a defensive portfolio management strategy (MacRumors).

In May 2018, RPX itself was acquired by HGGC, a Palo Alto-based private equity firm led by CEO Rich Lawson and NFL Hall-of-Famer Steve Young. HGGC took RPX private in a US $555 million deal (BusinessWire). HGGC’s acquisition shifted RPX’s operations further out of the public eye, turning it into a private-market IP management entity. Today, HGGC remains in control of RPX, which continues to manage, license, and retire patents—many of which still trace back to the original Nortel portfolio.

Simplified Timeline:

- 2011: Rockstar Consortium buys Nortel patents (US $4.5B)

- 2014: Rockstar sells 4,000+ patents to RPX (US $900M)

- 2018: HGGC acquires RPX (US $555M, private)

- 2025: HGGC still controls RPX, operating privately in patent risk management

So Who Controls HGGC?

HGGC is a private, middle‑market private equity firm headquartered in Palo Alto, California. It was co-founded in 2007 by Rich Lawson (CEO), Steve Young (NFL legend and Managing Partner), along with Harv Barenz, Les Brown, David Chung, Bill Conrad, Steve Leistner, Lance Taylor, and Neil White. These founders still actively lead the firm, serving as its key decision-makers and collectively maintaining control over its strategy and direction (https://en.wikipedia.org/wiki/HGGC, https://www.equitymethods.com/news-and-events/equity-methods-partners-with-hggc-unlocking-next-phase-of-growth).

In March 2019, Dyal Capital Partners (a division of Neuberger Berman) acquired a passive, non‑voting minority stake in HGGC. This investment did not affect HGGC’s governance or day-to-day operations; the founding leadership continued to run the firm independently (https://www.blueowl.com/news/hggc-receives-strategic-minority-investment-dyal-capital).

Furthermore, as of June 2022, HGGC raised Fund IV, closing at US $2.54 billion—its largest fund to date—with a significant capital commitment from its own General Partner and affiliates, ensuring the founding team maintains substantial influence and alignment of interest across all funds (https://www.businesswire.com/news/home/20220615006076/en/HGGC-Closes-Fund-IV-At-Over-%242.5-Billion).

BlackBerry’s Role in the Nortel Aftermath

BlackBerry, then known as Research In Motion (RIM), was a member of the Rockstar Consortium that purchased Nortel’s patent portfolio for US $4.5 billion in 2011. While BlackBerry did not take the operational lead in Rockstar’s litigation campaigns, its participation ensured it shared in both the licensing rights and potential revenue streams from the monetization of Nortel’s intellectual property (https://en.wikipedia.org/wiki/Rockstar_Consortium).

For BlackBerry, the deal was both a defensive and strategic move—protecting itself from potential patent assertions in the mobile communications space and gaining leverage against competitors. This was particularly important as BlackBerry’s handset market share was under pressure from Apple’s iPhone and Android devices. The portfolio strengthened BlackBerry’s patent licensing program, which later became a central pillar of its shift

STAY TUNED FOR SANDEEPS NEXT ARTICLE, “GHOST IN THE MACHINE”

The Ghost in Canada’s Machine

Nortel’s story is more than the collapse of a telecom giant—it is a mirror reflecting the vulnerabilities of a nation navigating the turbulent currents of global technology competition. It began with promise: a Canadian company defining the digital backbone of the modern world, pushing boundaries in fiber optics, wireless infrastructure, and enterprise networking. But it ended in bankruptcy court, its intellectual crown jewels scattered across the globe, and its workforce scattered with them.

The wreckage left scars. Investors lost fortunes, pensions evaporated, and Canadian policymakers were confronted with the uncomfortable truth that even a world leader in innovation can be brought low not only by market forces and management errors but also by the invisible hand of foreign intelligence. The later political crisis over Huawei’s CFO arrest underscored just how intertwined corporate fortunes and geopolitical power struggles had become.

From Bay Networks to Rockstar, from espionage allegations to multi-billion-dollar asset sales, Nortel’s fall was not an isolated business failure—it was the opening act in a new era where intellectual property is both currency and weapon. The lesson is unambiguous: in the global tech arena, safeguarding innovation is as much about national strategy as it is about corporate governance.

Canada has yet to produce another Nortel. Whether that absence is the result of caution, structural weakness, or the lingering specter of this collapse remains an open question. What is certain is that the ghost of Nortel still lingers—in court filings, in patent ledgers, in the vaults of foreign companies—and in the uneasy knowledge that a giant once stood here, and fell.

There is no David in this story. Nortel was beaten to death.

Disclaimer – Betweenplays Media

Betweenplays Media is a content-driven platform, delivering market insights, technology coverage, and geopolitical analysis for informational and educational purposes only. The views expressed are those of the authors and guests, based on publicly available information, personal analysis, and opinion. Nothing in this publication should be interpreted as investment advice, financial recommendations, or a solicitation to buy or sell any security. Always conduct your own research or consult a qualified financial professional before making any investment decisions. Betweenplays Media assumes no liability for any loss or damages arising from the use of this information.

Tags: #Technology, #TechNews, #TechInnovation, #FutureOfTech, #DigitalTransformation, #AI, #CyberSecurity, #CloudComputing, #Telecom, #TechTrends, #Investing, #StockMarket, #InvestorMindset, #InvestmentStrategy, #MarketTrends, #WealthManagement, #FinancialMarkets, #PortfolioManagement, #ValueInvesting, #InvestSmart, #LinkedInCommunity, #ProfessionalNetworking, #BusinessLeaders, #IndustryInsights, #CareerGrowth, #ThoughtLeadership, #WorkplaceCulture, #BusinessDevelopment, #NetworkingTips, #Leadership