By Betweenplays Media 🎙️ — August 2025

Abstract

The global transition toward electrified transportation is now defined by a high-stakes contest among battery manufacturers, whose technologies and production capabilities determine the pace, cost, and scale of electric vehicle (EV) adoption. This thesis examines the current leaders in EV battery production — companies already supplying batteries for EVs in mass production or poised to do so imminently — with a focus on their technological strategies, geographic reach, and market impact. The analysis reveals a landscape dominated by Chinese, South Korean, and Japanese manufacturers, with emerging players in Europe and the U.S. preparing to challenge incumbents through next-generation battery chemistries, regional production hubs, and strategic OEM partnerships.

Introduction

Electric vehicles have transitioned from niche products to core elements of national transportation strategies. Central to this shift is the EV battery — the single most expensive and technologically complex component of an electric vehicle. Battery performance defines an EV’s range, cost, charging time, and safety profile, while battery production capacity dictates the global supply chain’s ability to meet surging demand.

As of 2025, the EV battery industry is entering a decisive phase:

- Global EV sales are projected to surpass 18 million units in 2025, representing over 20% of new vehicle sales worldwide.

- Battery manufacturing capacity is consolidating around a handful of large-scale producers with advanced cell chemistry and vertically integrated supply chains.

- Next-generation battery technologies — including semi-solid-state and solid-state chemistries — are beginning to reach commercial deployment.

This paper identifies the top companies actively delivering EV batteries into vehicles on the road today or in the immediate future, analyzes their technological strategies, and evaluates their impact on the evolving EV ecosystem.

The Competitive Landscape of EV Battery Manufacturing

Market Concentration and Geographic Dominance

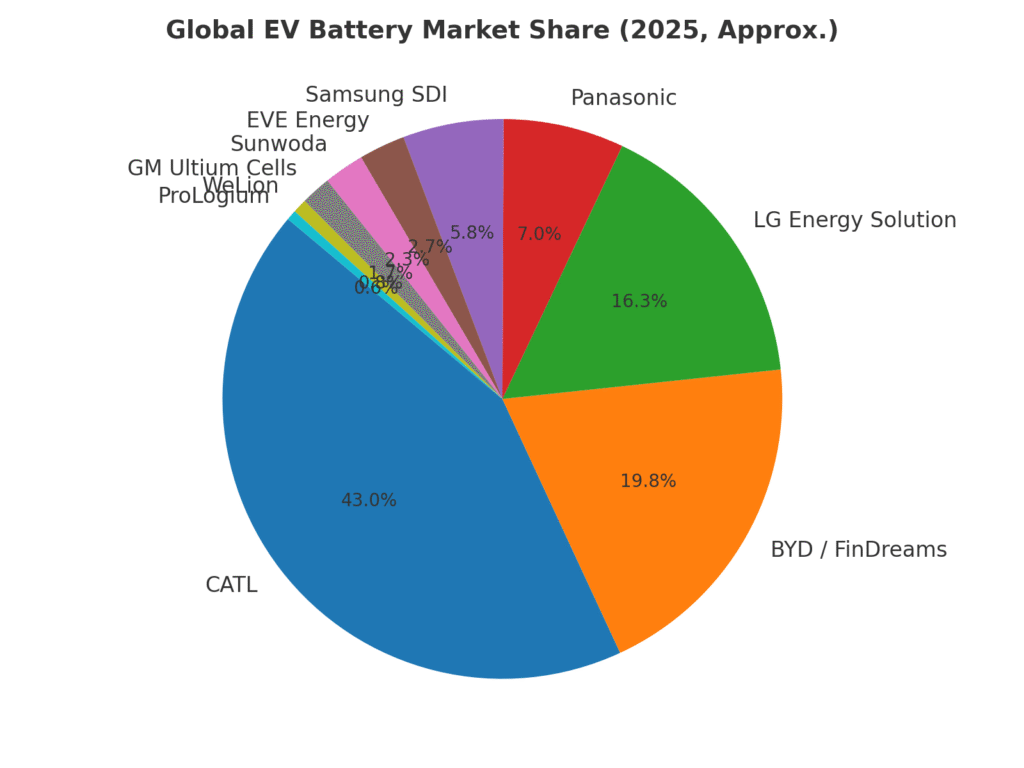

The EV battery market remains highly concentrated, with the top five producers accounting for over 80% of global supply.

China dominates both production volume and supply chain control, followed by South Korea and Japan, with Western manufacturers currently dependent on joint ventures or licensing arrangements to scale production.

Figure 1 — Global EV Battery Market Share (2025, Approx.):

Company Profiles and Technology Strategies

1. CATL (Contemporary Amperex Technology Co.)

- Global Market Share: ~37% — the largest EV battery supplier worldwide.

- Key Chemistries: LFP (Lithium Iron Phosphate), NCM (Nickel Cobalt Manganese), LMFP (Lithium Manganese Iron Phosphate), and sodium-ion.

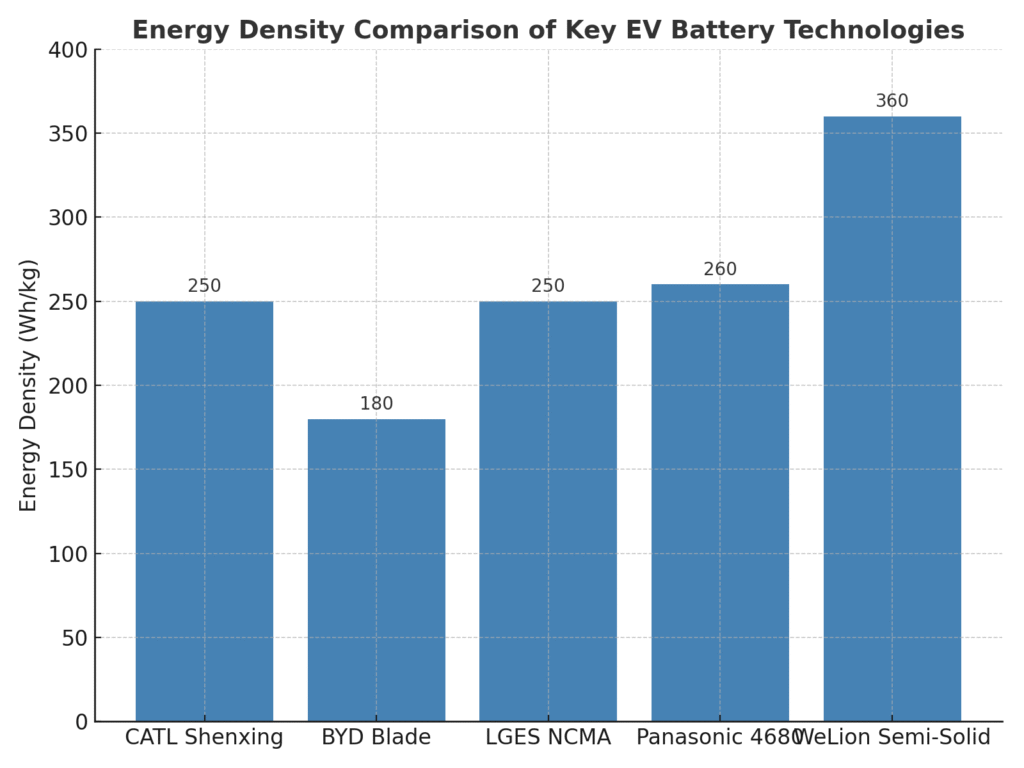

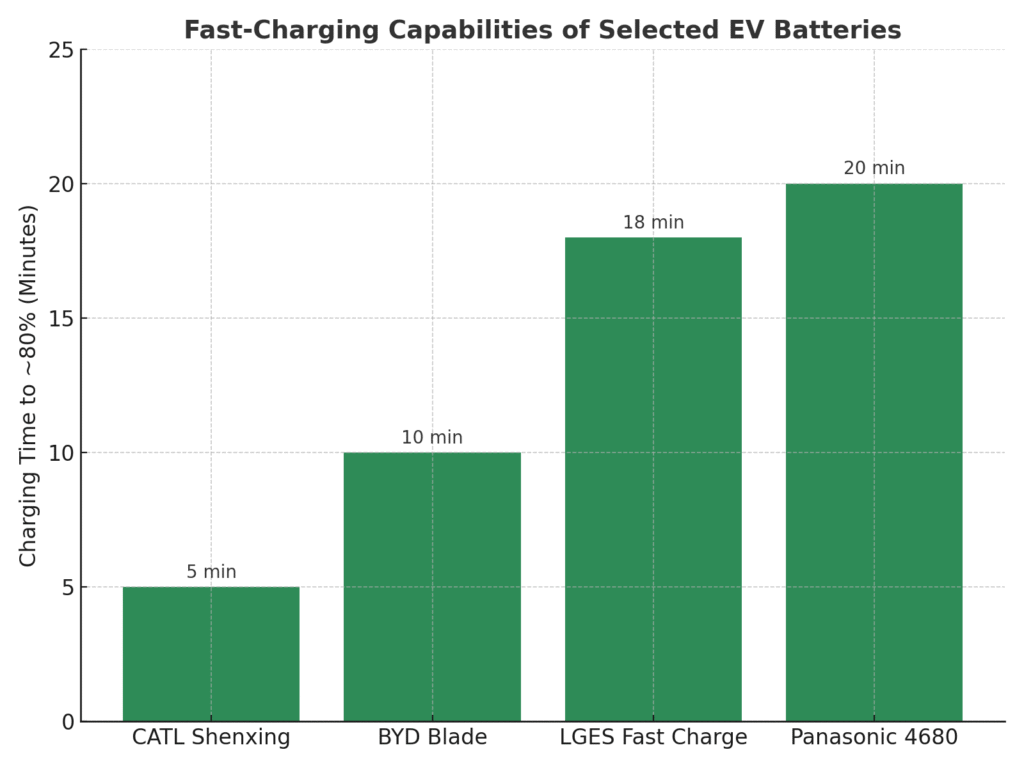

- Technological Edge: Second-generation Shenxing battery enables ~520 km range in 5 minutes of charging, exceptional cold-weather performance, and ultra-fast charging speeds.

- Strategic Positioning: Extensive OEM partnerships (Tesla, BMW, VW, etc.), vertical integration into raw materials, and early commercialization of sodium-ion batteries.

2. BYD / FinDreams

- Global Market Share: ~16–17%.

- Key Innovation: Blade Battery — ultra-safe LFP format with long cycle life and reduced thermal runaway risk.

- Deployment: Powers BYD’s own extensive EV lineup and is licensed to external automakers.

3. LG Energy Solution (LGES)

- Global Market Share: ~14%.

- Chemistries: NCM, NCMA, and ongoing solid-state R&D.

- OEM Clients: GM, Ford, Volkswagen, Stellantis.

- Strategic Moves: Multiple joint ventures with U.S. automakers; positioned as a key enabler of North America’s EV manufacturing base.

4. Panasonic Energy

- Historic Role: Longtime Tesla supplier; pioneer in cylindrical lithium-ion cells (NCA chemistry).

- Scaling Efforts: Launching large-scale 4680 cell production in Japan and the U.S., with a new $4 billion Kansas facility adding ~32 GWh/year capacity.

- Philosophy: Optimizing existing lithium-ion formats while cautiously approaching solid-state deployment.

5. Samsung SDI

- Global Share: ~5%.

- OEM Partnerships: Hyundai (cells from 2026), BMW, Stellantis.

- R&D Direction: Pursuing high-energy-density solid-state cells for early 2030s market entry.

6. EVE Energy

- Global Share: ~2.3%.

- Major Contracts: BMW Neue Klasse (Hungary plant), U.S. JV for commercial EVs.

- Technologies: LFP and NCM chemistries tailored for both consumer EVs and heavy transport.

7. Sunwoda

- OEM Reach: Geely, VW, Volvo, Li Auto.

- Production Footprint: China, Hungary, India, Morocco, Vietnam.

- Positioning: Rapidly scaling to challenge mid-tier incumbents through geographic diversification.

8. GM Ultium Cells (GM + LGES JV)

- Chemistry: Proprietary NCMA pouch cells.

- Deployment: Standardized across GM BEVs; supply agreements with Honda/Acura.

- Facilities: Multi-state U.S. footprint with massive scaling potential.

9. WeLion (Semi-Solid-State Leader)

- Innovation: 150 kWh semi-solid-state pack with ~360 Wh/kg energy density, enabling ~1,050 km range.

- Deployment: Already in NIO ET7 sedans via swappable pack architecture.

10. ProLogium (Solid-State Pioneer)

- Current Status: Pilot-scale solid-state production in Taiwan; Dunkirk gigafactory (France) under development for 2027.

- Outlook: Aiming for first solid-state EV deployment in the next 2–3 years.

Comparative Technology Metrics

Figure 2 — Energy Density of Key EV Battery Technologies:

Figure 3 — Fast-Charging Performance Across Leading EV Batteries:

Technology Trends and Market Dynamics

- Chemistry Diversification — OEMs are no longer tied to one battery chemistry; LFP, NCM, LMFP, sodium-ion, and semi-solid-state are all in active commercial use.

- Regionalization of Supply Chains — Driven by geopolitics, tariffs, and incentives like the U.S. Inflation Reduction Act.

- Charging Speed Arms Race — CATL and BYD are pushing sub-10-minute charge times as a key differentiator.

- Solid-State Transition — Still years from mass-market, but early semi-solid deployments (WeLion) are proving feasibility.

Conclusion: The Next Decade in Perspective

The EV battery industry is entering a period of intense scale-up and technological divergence. China’s CATL and BYD remain dominant, but South Korean and Japanese firms are leveraging Western partnerships to secure regional footholds. Semi-solid-state and future solid-state batteries will gradually erode lithium-ion’s dominance, but for the near term, incremental improvements to existing chemistries and massive capacity expansion will define the competitive race.

For investors, policymakers, and industry strategists, these companies are not merely suppliers — they are gatekeepers of the electric transition. The winners will be those who can scale without sacrificing innovation, navigate geopolitical supply constraints, and integrate their products into OEM ecosystems at speed.

Disclaimer – Betweenplays Media

Betweenplays Media is a content-driven platform, delivering market insights, technology coverage, and geopolitical analysis for informational and educational purposes only. The views expressed are those of the authors and guests, based on publicly available information, personal analysis, and opinion. Nothing in this publication should be interpreted as investment advice, financial recommendations, or a solicitation to buy or sell any security. Always conduct your own research or consult a qualified financial professional before making any investment decisions. Betweenplays Media assumes no liability for any loss or damages arising from the use of this information.

MESSAGE TO READER: On August 9th, 2024, a catastrophic backflow flood — triggered by extreme weather — inundated my home and studio with over 3½ feet of contaminated water. The disaster destroyed all broadcasting equipment, wiped out my HVAC system, and forced a full-scale demolition and sterilization of the basement. The rebuild required months of intense, hands-on labor, further complicated by a serious inguinal hernia caused by the physical strain of recovery work, which later required surgery.

Despite the loss of a year of production for Betweenplays Media, the crisis became a period of behind-the-scenes rebuilding — upgrading the studio, mastering new editing skills, expanding professional networks, and re-strategizing content direction.

Now, in September 2025, the payoff is here: interview requests are piling up, high-profile opportunities are lining up back-to-back, and the platform is entering a sustained growth phase. What began as a nightmare has become the foundation for the strongest relaunch in the brand’s history.