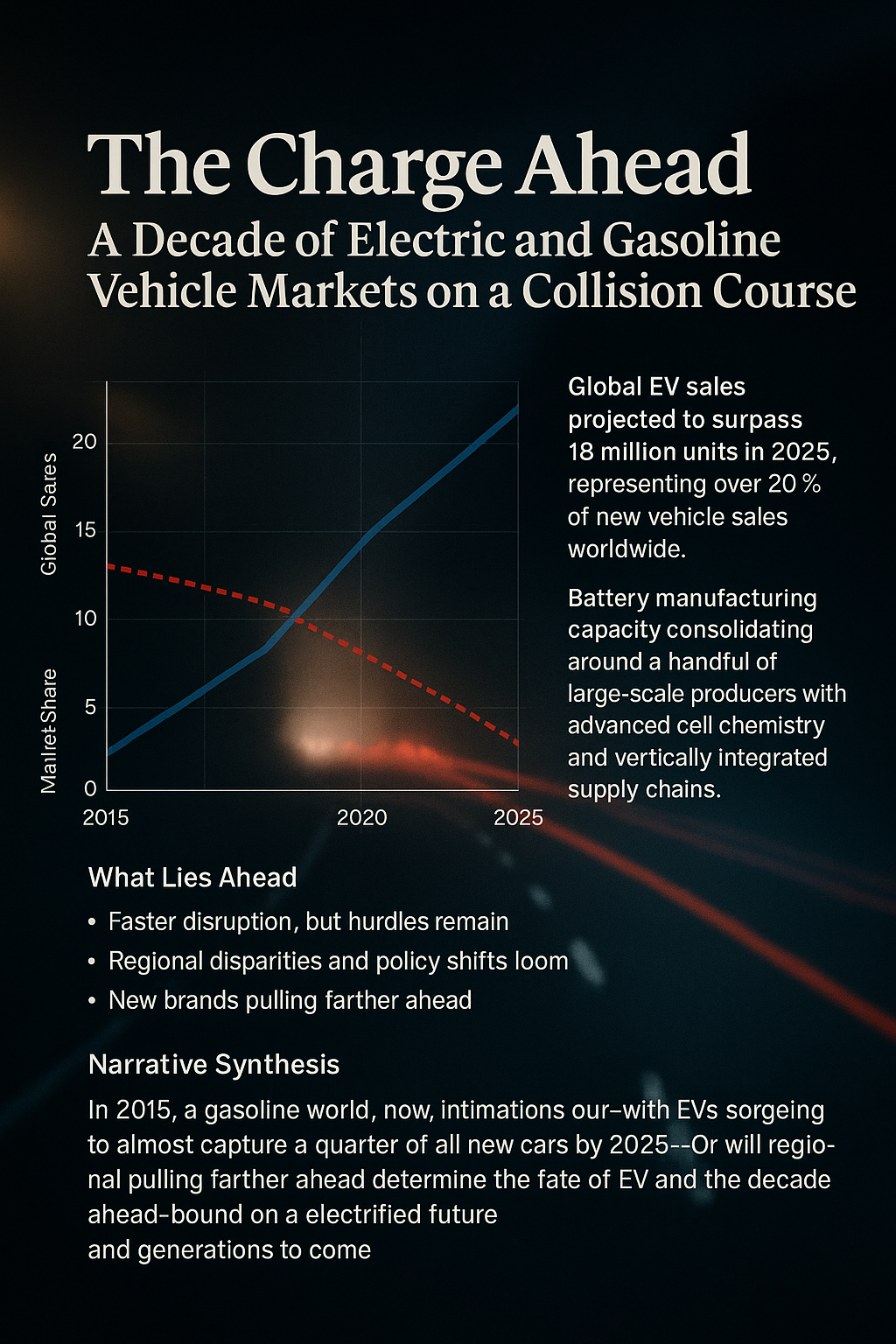

The Charge Ahead: A Decade of Electric and Gasoline Vehicle Markets on a Collision Course

The morning air in Shanghai carries little more than the soft hum of electric cars assembling in lines at city traffic lights, their altogether smoother cadence replacing the familiar thrum of combustion engines. A decade ago, in 2015, these EVs were rare novelties. Today, they represent a pivotal shift in how the world moves—one illuminated not just by increased adoption, but by the unfolding decline of gasoline’s reign.

1. From Whisper to Roar: The EV Takeoff, 2015–2025

In September 2015, global cumulative sales of plug-in electric vehicles—BEVs and PHEVs combined—reached the first million units. At that time, the segment was truly niche.(Wikipedia) By the end of 2018, that number quintupled to 5 million, and by 2020, it doubled again, taking the cumulative stock to 10 million.(Wikipedia)

Sales momentum gathered in the early 2020s. In 2021, plug-ins grabbed roughly 9% of new car sales globally—up from just 2.5% in 2019.(Wikipedia, IEA) By the close of 2023, EVs accounted for nearly 18% of all new car sales worldwide.(IEA, Our World in Data)

Then, in 2024, the EV era felt almost unstoppable: global EV sales exceeded 17 million, representing over 20% of new cars sold and growing more than 25% year‑on‑year.(IEA) The trend surged into 2025: over 4 million EVs sold in Q1 alone—an increase of 35% compared to the same period in 2024—and annual sales are expected to top 20 million, capturing 25% or more of the global market.(IEA)

2. The Gasoline Paradox: Lost Ground or Still Strong?

While comprehensive global data for gasoline vehicle sales year by year is less headline-ready, the broader figure is clear: EVs are steadily encroaching on what was once the unchallenged domain of gasoline vehicles. In 2015, the automotive landscape was overwhelmingly fossil-fuel powered—with plug-ins accounting for near zero percent of new vehicle sales.

By 2023, EVs represented nearly 18% of new sales—meaning gasoline/diesel still held roughly 82%—a dramatic decline from a near-total dominance just eight years earlier.(IEA, Our World in Data) By 2024, that gap narrowed further: EVs held about 20%, leaving gasoline at around 80%.(IEA, The Australian) And as we head into 2025, the gap is poised to close more tightly, with EVs poised to take one in four new car sales globally.(The Australian)

This trajectory is not uniform across regions. In China, EVs reached nearly 50% of new car sales in 2024.(IEA) In Europe, the share hovered around 20%, stable yet increasingly mainstream. In the U.S., EV penetration remained lower—around 10% in early 2025—constrained by higher prices, limited low-cost models, and a stalled subsidy environment.(The Australian)

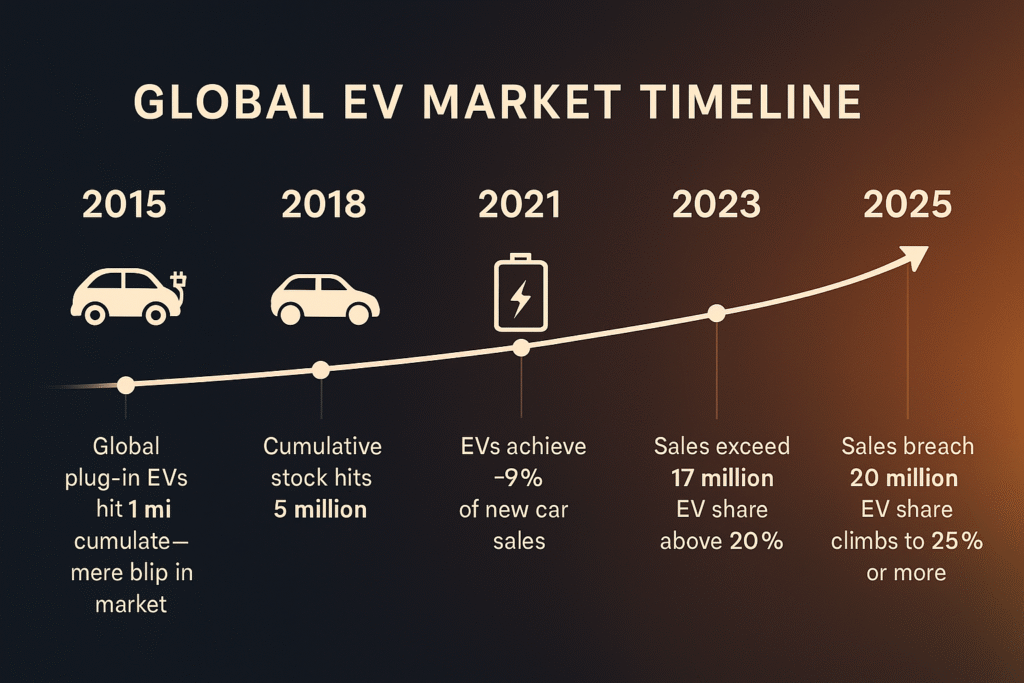

3. The Turning of a Decade: Key Milestones (2015–2025)

- 2015: Global plug-in EV sales hit 1 million cumulative—mere blip in market.

- 2018: Cumulative stock hits 5 million.

- 2020: Stock doubles to 10 million.

- 2021: EVs achieve ~9% of new car sales.

- 2023: EVs reach ~18% of new vehicle share.

- 2024: Sales exceed 17 million, EV share above 20%.

- 2025 (projected): Sales breach 20 million, EV share climbs to 25% or more.(Wikipedia, Wikipedia, IEA)

4. What Lies Ahead: 2025–2030 and Beyond

Looking forward, the pace of disruption may accelerate—but hurdles remain.

In a net-zero-aligned scenario, EVs could make up as much as 65% of new car sales by 2030, though achieving that would require sustained 23% annual growth in EV sales from 2024 onward—comparable to the explosive 2023 growth.(IEA)

Still, regional disparities and policy shifts loom. For example, the United States has seen its 2030 EV forecast cut from previous estimates—largely due to rollback of incentives under the current administration.(The Australian, washingtonpost.com, axios.com)

Meanwhile, China is pulling farther ahead, with domestic brands like BYD rapidly expanding—achieving sales of 4.27 million vehicles in 2024, of which 34% were new energy vehicles; BYD has overtaken Tesla to become the world’s largest EV seller.(Wikipedia)

Narrative Synthesis: A Decade Defined by Disruption

In a 2015 world, gasoline engines invaded roads with their familiar growl, and EVs were curiosities—expensive, rare, and dismissed by many. Today, in 2025, the hum of EVs is a global soundtrack—more common in city centers and quiet suburbs alike. What felt novel is now inexorable.

This decade-long duel between electrons and hydrocarbons isn’t over. Gasoline still commands the majority of global vehicle sales—but its dominance is slipping. The momentum is clear: EVs surged from almost zero share in 2015 to possibly capturing a quarter of all new cars by 2025.

The next five years may define whether EVs win their longstanding battle. Will policy, infrastructure, and cost parity tip the scales decisively? Or will regional roadblocks—like U.S. subsidy reversals or Europe’s faltering incentives—create cracks in the electrified future?

What’s certain is that the decade ahead won’t just be about new vehicles—it will determine the fate of a global industry and reshape economic, industrial, and environmental landscapes for generations to come.

Investor’s Lens: Where the Next Decade’s Value Could Be Forged

For speculators and long-horizon investors, the EV surge is more than a consumer trend—it’s a macroeconomic realignment. Battery manufacturing, raw material sourcing, and electric drivetrain technology are emerging as the backbone of the next industrial cycle. The growth trajectory is clear: most global battery and EV-related sectors are tracking positive CAGR in the high single to low double digits through 2030, powered by scaling gigafactories, vertical integration, and an accelerating adoption curve in key markets.

Companies worth monitoring span multiple points in the value chain:

- Cell & Pack Manufacturing: CATL, BYD, LG Energy Solution, Panasonic, Samsung SDI.

- Automakers Leading EV Transition: Tesla (TSLA), BYD (BYDDY), Geely (GELYF), SAIC, and legacy OEMs scaling EV lines such as Volkswagen (VWAGY), Ford (F), and GM (GM).

- Mining & Processing for Battery Metals: Albemarle (ALB), SQM, Ganfeng Lithium, Livent (LTHM), Pilbara Minerals, Sigma Lithium.

- Battery Tech Innovators: QuantumScape (QS), Solid Power (SLDP), ProLogium, StoreDot.

With Canada’s new fast-track federal legislation for major resource projects and Quebec’s aggressive critical minerals strategy, domestic developers like First Phosphate, E3 Lithium, Talon Metals, Brunswick Exploration, Patriot Battery Metals, and Osisko Metals could become pivotal suppliers for North America’s EV and storage industries—operating in stable jurisdictions and aligned with supply-chain security mandates.

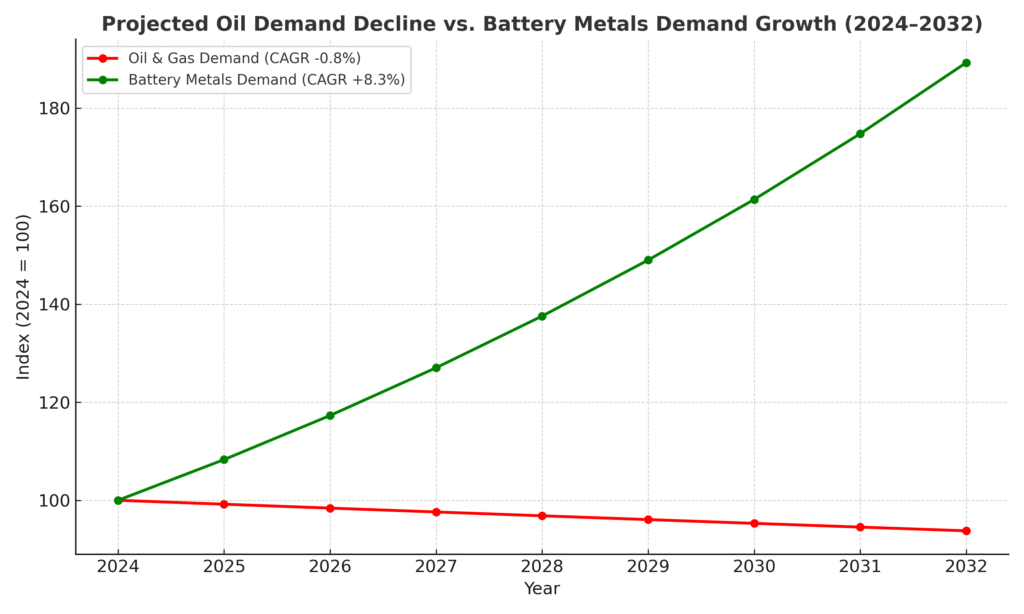

Meanwhile, the oil and gas sector is beginning to show early signs of a negative or flat CAGR in mature markets when adjusted for efficiency gains and rising EV penetration. Short-term price spikes will remain possible due to geopolitical or supply shocks, but the long-term gasoline demand curve is flattening and projected to decline as fleet electrification scales.

By contrast, the battery ecosystem—spanning mining, refining, manufacturing, and recycling—maintains a clear positive CAGR trajectory, reinforced by global policy frameworks and the inevitability of grid-scale storage demand. Beyond vehicles, batteries are set to underpin renewable energy reliability, industrial backup systems, and decentralized power.

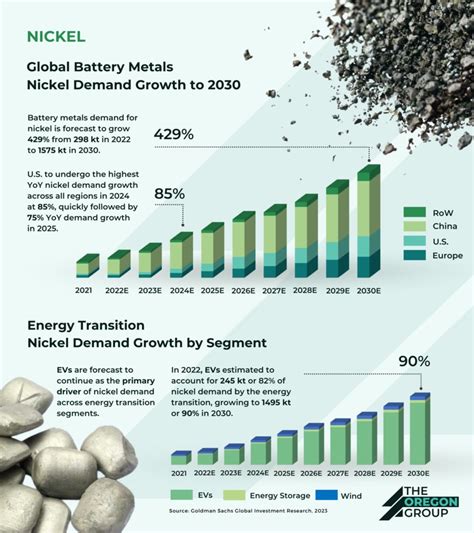

Chart Details & Context

Visual Explanation: This stacked-bar chart illustrates projected global demand for nickel—a critical battery metal—from 2021 through 2030. The bars geographically segment demand across regions: US, Europe, China, and Rest of World. The dramatic heightening of demand, especially in the second half of the decade, underscores the explosive growth tied to electrification, EVs, and energy storage.(The Wall Street Journal, Canadian Mining Journal)

Oil Demand Outlook: Flatlining in Mature Markets

While precise visual data for oil demand was not returned in image search results, credible sources confirm a stagnating to slightly declining trend in mature markets:

- Global gasoline demand is expected to peak around 2025, driven by EV adoption and improvements in fuel efficiency. This creates pressure on refining margins and could force rationalization of existing capacity.(IEA Blob Storage, S&P Global)

- IEA reports that oil demand growth slowed to just 0.8% in 2024, down from 1.9% in 2023. Demand from road transport, a major driver, is increasingly offset by EV adoption, while oil’s share of total energy demand fell below 30% in 2024.(IEA)

- Further analysis from RMI indicates oil demand for passenger cars peaked in 2019 and is expected to decline annually by over 1 million barrels per day by 2030, marking a structural shift.(RMI)

Supporting Projections & Sources for Investors

| Sector | Trend / CAGR | Source |

|---|---|---|

| Battery Metals | ~8–10% CAGR (2024–2030+) | Grand View Research, IDTechEx (Grand View Research) |

| Battery Energy Storage | ~19.6% CAGR through 2032 | Fortune Business Insights (Fortune Business Insights) |

| Lithium-Ion Batteries | ~10.3% CAGR to 2033 | Markets & Markets (MarketsandMarkets) |

- Battery Metals Market: Estimated at US$10.7 billion in 2023, expected to grow at ~8.3% CAGR through 2030.(Grand View Research)

- Critical Battery Materials (Lithium, Cobalt, Nickel, Graphite): Value expected to triple with ~10.6% CAGR from 2025 to 2035.(IDTechEx)

- Energy Storage (BESS): Forecast to rise from US$25B in 2024 to over US$114B by 2032, a 19.58% CAGR.(Fortune Business Insights)

- Lithium-Ion Battery Market: Projected from ~US$195B in 2025 to US$426B by 2033, translating to 10.3% CAGR.(MarketsandMarkets)

Summary for Investors

- Battery-related sectors—from metals to energy storage—are experiencing strong, positive CAGR growth (8–20%), reflecting rising demand for electrification, grid storage, and clean energy infrastructure.

- Oil demand, especially for transportation fuels, is plateauing or beginning to decline, particularly in advanced economies. EV penetration and efficiency improvements are shifting demand dynamics.

- For speculators and strategic investors, the battery ecosystem offers clear growth and momentum—backed by policy, conversion trends, and long-term industrial demand.

References

- International Energy Agency (IEA) – Oil 2024: Analysis and Forecast to 2029

https://iea.org/reports/oil-2024

Covers global oil demand forecasts, regional breakdowns, and the impact of EV adoption on transport fuel demand. - IEA – Global EV Outlook 2025

https://iea.org/reports/global-ev-outlook-2025

Comprehensive analysis of EV market penetration and implications for oil displacement. - RMI – X Change Cars Report

https://rmi.org/wp-content/uploads/dlm_uploads/2023/09/x_change_cars_report.pdf

Demonstrates that oil demand for passenger vehicles peaked in 2019, with projected annual declines exceeding 1 million barrels/day by 2030. - Markets & Markets – Lithium-Ion Battery Market Forecast

https://marketsandmarkets.com/Market-Reports/lithium-ion-battery-market-49714593.html

Market size projections, growth rate, and sectoral demand breakdowns for lithium-ion batteries. - Grand View Research – Battery Metals Market

https://grandviewresearch.com/industry-analysis/battery-metals-market

Forecasts for lithium, nickel, cobalt, and graphite markets, including CAGR analysis and drivers. - Fortune Business Insights – Battery Energy Storage Market

https://fortunebusinessinsights.com/industry-reports/battery-energy-storage-market-100489

Examines global energy storage demand growth across grid and industrial applications.

Future Reading

- BloombergNEF – Electric Vehicle Outlook

Annual report modeling EV adoption, charging infrastructure needs, and mineral demand forecasts.

https://about.bnef.com/electric-vehicle-outlook/ - US Geological Survey – Mineral Commodity Summaries

Yearly data on global production, reserves, and trade flows of critical minerals like lithium, nickel, and cobalt.

https://usgs.gov/centers/national-minerals-information-center/mineral-commodity-summaries - Canadian Critical Minerals Strategy (Government of Canada)

Policy roadmap for securing domestic supply of EV and battery materials.

https://nrcan.gc.ca/critical-minerals-strategy - International Renewable Energy Agency (IRENA) – Geopolitics of the Energy Transformation

Analyzes the mineral demand implications of the clean energy transition.

https://irena.org/publications - World Bank – Minerals for Climate Action Report

Forecasts mineral requirements under various climate scenarios, including 2°C and 1.5°C pathways.

https://worldbank.org/en/topic/extractiveindustries/publication/minerals-for-climate-action

Disclaimer – Betweenplays Media

Betweenplays Media is a content-driven platform, delivering market insights, technology coverage, and geopolitical analysis for informational and educational purposes only. The views expressed are those of the authors and guests, based on publicly available information, personal analysis, and opinion. Nothing in this publication should be interpreted as investment advice, financial recommendations, or a solicitation to buy or sell any security. Always conduct your own research or consult a qualified financial professional before making any investment decisions. Betweenplays Media assumes no liability for any loss or damages arising from the use of this information.

EVmarket #ElectricVehicles #GasolineVsEV #BatteryTechnology #AutoIndustryTrends #EVsales2025 #SolidStateBatteries #EnergyTransition #GlobalCarMarket #CleanTransport #EVadoption #FutureOfDriving #AutoNews #MarketShift #GreenTech #InvestingInEV $TSLA $BYDDY $NIO $F $GM $RIVN $LCID $TM $VWAGY $NKLA