🎙️ Betweenplays Media Inc™ Feature — Not Financial Advice

A Moment of Reversal and Revelation – The Chips, Telecom & Intelligence Revolution

In the twilight of 2025, while much of the world’s attention fixated on quarterly earnings, semiconductor shortages, and AI model releases, a quieter event occurred—one that may ultimately reshape the architecture of modern technology investment. SoftBank Group Corp., the Japanese investment titan known for its sweeping bets on the future, began unwinding two of its most significant positions: its remaining stake in NVIDIA Corporation, and a substantial portion of its shares in T-Mobile US.

The numbers alone were striking: a US $5.8 billion sale of NVIDIA shares, and roughly US $9 billion worth of T-Mobile stock offloaded over the span of a few months (Associated Press, 2025; Reuters, 2025). But what made these transactions seismic was not their scale—it was what they represented.

SoftBank wasn’t retreating from technology. It was rotating its gravitational pull—away from silicon, spectrum, and infrastructure ownership, and toward the intelligence layer itself: the world of AI platforms, generative compute, and autonomous cognition.

This was not a tactical rebalancing. It was the opening move in what Masayoshi Son later called “the intelligence revolution”—a structural reshaping of where value, power, and capital will live in the next decade (Barron’s, 2025).

“The smartphone was the first stage,” Son declared, “but now we enter the era where machines think, decide, and create. Our mission is to fund that revolution.” (Barron’s, 2025)

The Anatomy of a Great Rotation

To understand why this moment matters, one must first recall the unique nature of SoftBank’s empire. Over the past two decades, Son’s Vision Fund has acted less like a conventional venture portfolio and more like a sovereign capital engine—an entity capable of tilting the global innovation axis through sheer volume of belief (and liquidity).

In the early 2010s, that belief materialized as a bet on mobile data and consumer connectivity. SoftBank acquired telecom carriers, funded app ecosystems, and injected capital into an emerging generation of “mobile-first” businesses. By 2018, it had accumulated stakes in everything from Uber to ARM, T-Mobile to NVIDIA.

But by 2025, the vectors of growth had shifted. The mobile internet had matured into oligopolistic stability, while AI had exploded into exponential velocity. The real bottlenecks were no longer distribution or access—they were compute, energy, and trust.

“We’ve completed the sale of our NVIDIA stake, but this has nothing to do with NVIDIA itself,”said Yoshimitsu Goto, SoftBank’s CFO. “It’s about reallocating capital to prepare for the next stage of AI.” (Associated Press, 2025)

The “next stage” he referred to is AI infrastructure at planetary scale—projects such as OpenAI’s “Stargate,” a planned hyperscale data-centre network designed to power the next generation of artificial cognition (AP News, 2025).

To fund that ambition, SoftBank cashed out of two of its most profitable but mature positions—NVIDIA, the emblem of the current AI boom, and T-Mobile, the steady telecom workhorse of the last one.

In short, it sold yesterday’s heroes to buy tomorrow’s scaffolding.

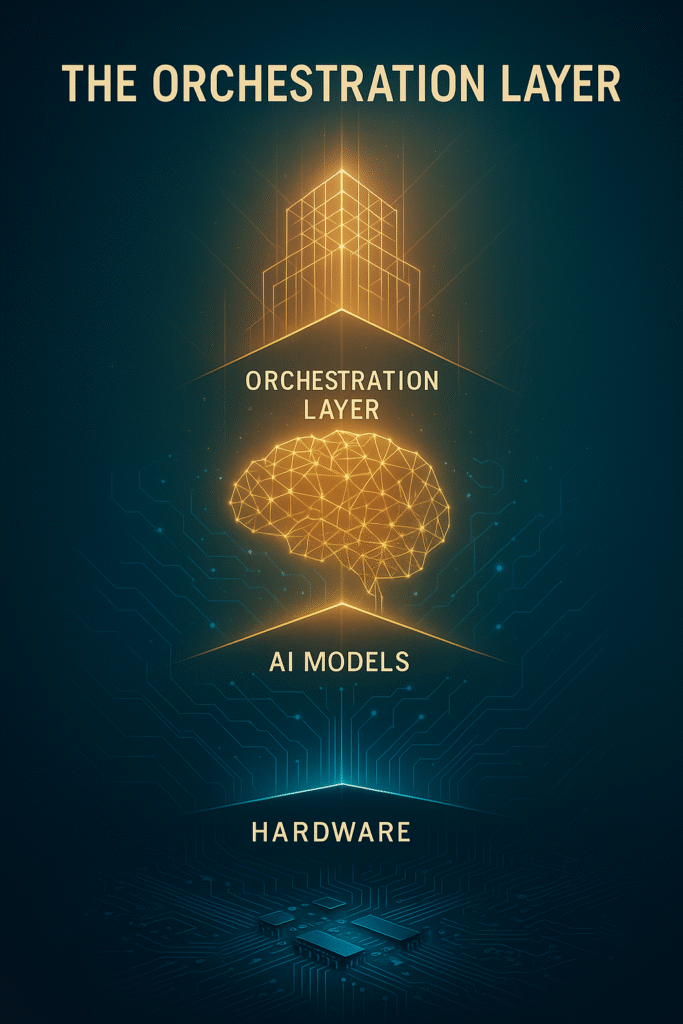

From Hardware to the Stack: Owning the Orchestration Layer

SoftBank’s rotation reflects a broader philosophical evolution occurring across global capital markets: a recognition that the locus of value has moved upward.

In the early stages of every technological revolution, the “enabling layer” captures the profits—railroads in the 1800s, silicon in the 1990s, and bandwidth in the 2000s. But once infrastructure becomes abundant, the next layer—the orchestration layer—absorbs the returns.

That layer, in 2025, is the AI infrastructure stack. It’s not just chips, or networks, or models—it’s the synchronized choreography of all three, connected through power, governance, and data integrity.

“Hardware lights the spark,” said Ritu Jyoti, IDC’s Group Vice-President for Worldwide AI Research, “but orchestration sustains the flame. Every millisecond, every inference, every watt—it all converts directly to enterprise value.” (IDC Brief, 2025)

SoftBank’s capital reallocation makes it one of the first global institutions to explicitly price intelligence as infrastructure—a paradigm that collapses the boundaries between compute, energy, and cognition.

A Market Trying to Catch Its Breath

As of November 11 2025, SoftBank’s U.S. ADR (SFTBY) traded at US $70.47, up from mid-year lows, while its Tokyo listing (9984.T) hovered around ¥11,500 (Morningstar, 2025; Trading Economics, 2025). Analysts interpreted the moves as both opportunistic and visionary: a cash-out at the top of one wave, and a capital redeployment into the next.

“Investors see this as strategic maturity,” explained Mio Kato of LightStream Research. “SoftBank is rotating from hardware profits to infrastructure control—exactly where the next ten years of AI margin will accumulate.” (The Guardian, 2025)

But confidence remains cautious. The scale of SoftBank’s new ambitions—multi-gigawatt data-centres, generative compute grids, AI energy optimization—requires not only vast capital but also regulatory finesse, power-grid cooperation, and technical discipline. The upside is transformative; the execution risk, existential.

Emerging Transformational Technologies for Enterprise

For enterprise technology leaders, this rotation is more than a financial maneuver—it’s a roadmap. It reveals how fast the corporate stack itself is changing.

Where once CIOs and CTOs discussed digital transformation in terms of migrating workloads to the cloud, now the conversation has turned to AI operationalization—deploying, securing, and governing models that make autonomous decisions.

“Latency is the new liability,” noted Ritu Jyoti in a recent IDC survey. “Every millisecond now touches the balance sheet.” (IDC Brief, 2025)

In this context, the consulting and integration landscape is being rewritten. Firms that merely implement software will fade; those that build governance frameworks, engineer compliance pipelines, and quantify AI’s financial value will thrive.

This is the essence of the new enterprise consulting mandate: convert intelligence into measurable trust.

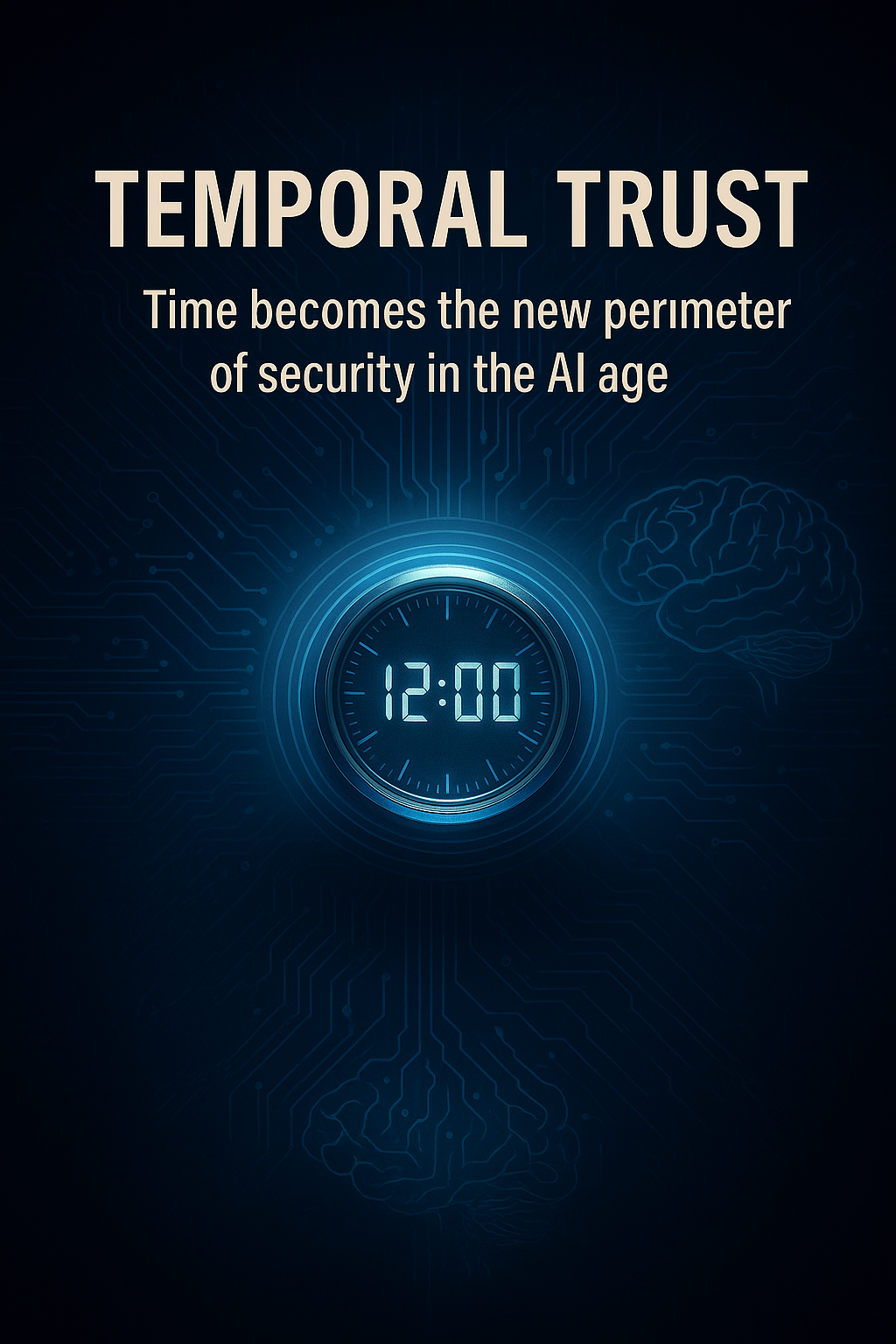

Security, Provenance, and Temporal Trust

As AI systems expand across industries—from healthcare to finance to critical infrastructure—the question of time and trust has become paramount.

If AI outputs are to be audited, they must be anchored in verifiable chronology. Who executed the model? On what data? At what moment? In what jurisdiction?

Secure time-protocols like NTP/NTS and PTP, long taken for granted in telecoms and finance, are re-emerging as critical tools for AI forensics. Advanced architectures will rely on entropic time modeling—a concept that ensures not just data integrity, but temporal integrity.

“Time will become the new security perimeter,” said Nadia Carlsten, VP of Product at Trail of Bits. “If you can’t prove when something happened, you can’t prove that it happened securely.”(IEEE Spectrum, 2025)

For consultants and integrators, this new layer of security—the synchronization of time, truth, and inference—will become a differentiator. It represents the fusion of cybersecurity, compliance, and AI-governance engineering into one unified practice. I like to call it Temporal Assurance Engineering, a nascent field where the future of time itself will be held.

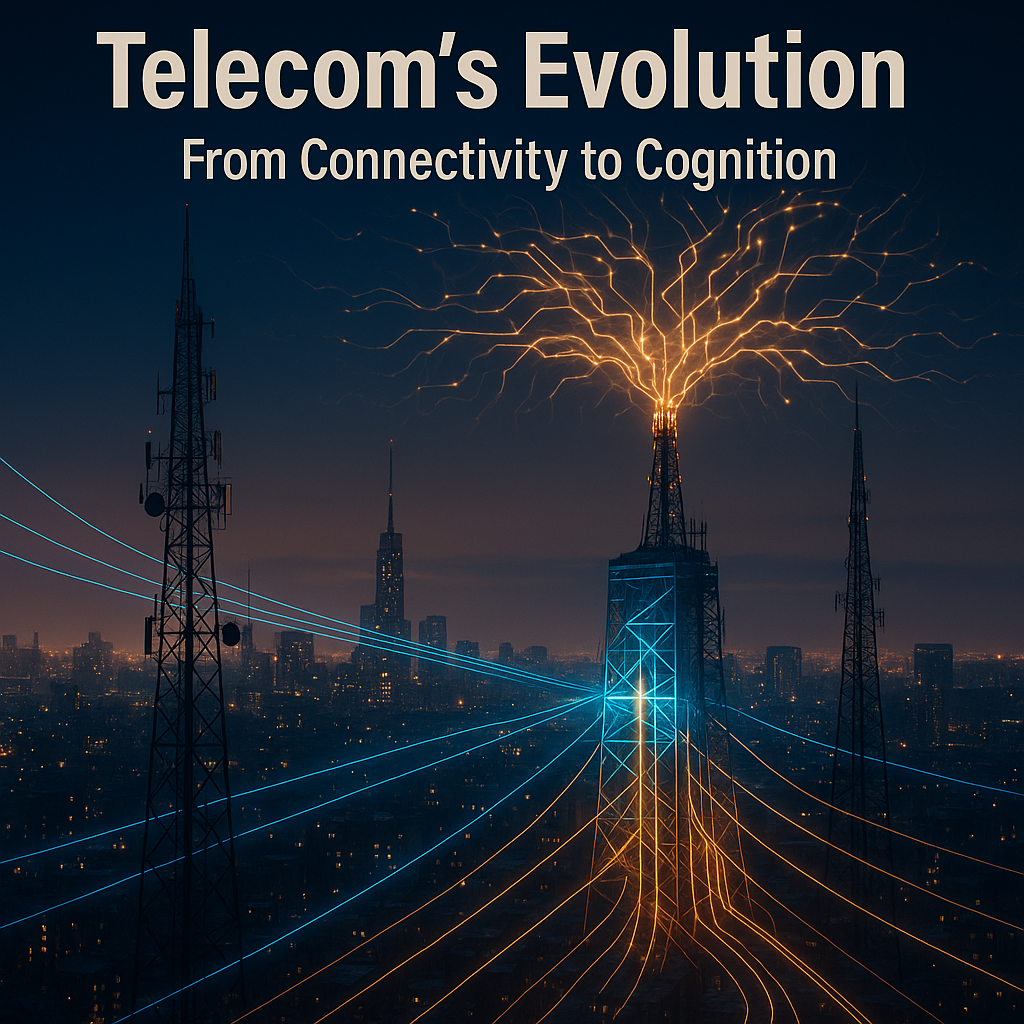

Telecom’s Evolution: From Connectivity to Cognition

SoftBank’s partial exit from T-Mobile is emblematic of a sector-wide reality: the margins in telecom are collapsing. Connectivity has become the electricity of the digital era—essential but commoditized. The new frontier is intelligence infrastructure—networks that don’t just transport information but process, filter, and act upon it at the edge.

“Telcos that stop at connectivity will miss the intelligence wave,” warned Phil Kornbluth, former CTO of BT Group (Financial Times, 2025). “Networks must evolve into decision fabrics.”

In practice, this means the traditional distinction between telecom, cloud, and compute is dissolving. For enterprise clients, “modernization” now entails deterministic latency, secure edge inference, and zero-trust architecture—concepts that blend network design with cognitive orchestration.

The Opportunity Gap: Integration as the New Gold Rush

The irony of the AI era is that while compute capacity is abundant, operational capacity is scarce. Hyperscalers and AI labs can build the models; they cannot easily deploy them across fragmented corporate environments laden with regulation and risk.

This is where the next consulting gold rush lies. The market needs integration partners—firms capable of translating AI strategy into executable infrastructure.

SoftBank’s capital shift indirectly validates this market. The billions moving from chip and telecom holdings into AI infrastructure will fund an ecosystem of third-party specialists—consultants, MSPs, and security integrators who can deliver AI readiness, compliance frameworks, and temporal assurance at enterprise scale.

Risks on the Horizon

Yet, every inflection point hides fragility. The AI-infrastructure boom depends on scarce resources: high-efficiency transformers, rare-earth supply chains, specialized cooling systems, and an energy grid already under strain (The Guardian, 2025).

“We should expect short cycles of euphoria and correction as capital hunts for real returns in AI,” cautioned Richard Windsor, founder of Radio Free Mobile (Bloomberg TV, 2025).

Regulatory scrutiny is tightening too. From the EU’s AI Act to U.S. export controls on advanced semiconductors, compliance will define deployment velocity. For consultancies and integrators, this means embedding scenario planning and geopolitical risk modeling into their service DNA.

Time as the New Competitive Frontier

Beneath the financial and technical layers of this rotation lies a subtler theme: time—not as metaphor, but as measurable resource.

The 2000s rewarded connectivity, the 2010s computation, the 2020s coordination. The 2030s will reward synchronization—the capacity to align data, models, and decision cycles in trusted temporal order.

“In the AI economy, time is truth,” wrote Kate Crawford in Nature Machine Intelligence(2025).

SoftBank’s moves, when viewed through this lens, look less like trading and more like temporal positioning—aligning its capital to the cadence of the next technological epoch.

Architecture of a New Epoch

SoftBank’s divestments from NVIDIA and T-Mobile are not retreats; they are recalibrations—a re-anchoring of ambition toward a world where intelligence is the infrastructure.

“The future isn’t waiting for hardware to catch up,” Son said in Tokyo. “It’s waiting for our imagination to do so.” (AP News, 2025)

In this statement lies the essence of The Great Rotation: a migration of capital from the tangible to the cognitive, from the chip to the stack, from infrastructure that moves electrons to infrastructure that thinks.

For enterprise technologists and consultants, this marks a generational turning point. The companies that learn to engineer trust, time, and intelligence into their systems will not simply adapt to this future—they will design it.

REFERENCES

Associated Press. (2025, November 11). Japan’s SoftBank says it has sold its shares in NVIDIA for $5.8 billion, turning its focus to OpenAI.

https://apnews.com/article/d8a10172850628c317a214280a4d94c9

Barron’s. (2025, November 11). Why SoftBank is ditching NVIDIA for ChatGPT.

https://www.barrons.com/articles/softbank-openai-nvidia-stake-ai-5036b58b

DataCenter Dynamics. (2025, September 17). SoftBank scoops $9.2 billion from partial T-Mobile stake sale.

https://www.datacenterdynamics.com/en/news/softbank-scoops-92bn-from-partial-t-mobile-stake-sale

Reuters. (2025, June 17). SoftBank raises $4.8 billion from T-Mobile block trade, term sheet shows.

https://www.reuters.com/business/media-telecom/softbank-raises-48-billion-t-mobile-block-trade-term-sheet-shows-2025-06-17

Tom’s Hardware. (2025, November 10). SoftBank exits NVIDIA with $5.83 billion sale.

https://www.tomshardware.com/tech-industry/softbank-exits-nvidia-with-5-83-billion-sale

The Guardian. (2025, November 11). SoftBank sells stake in NVIDIA as it doubles down on OpenAI bets.

https://www.theguardian.com/business/2025/nov/11/softbank-sells-stake-in-nvidia-as-it-doubles-down-on-openai-bets

Morningstar. (2025, November 11). SoftBank Group ADR (SFTBY) stock quote & performance.

https://www.morningstar.com/stocks/pinx/sftby/quote

Trading Economics. (2025, November 11). SoftBank Group Corp — 9984.T stock price.

https://tradingeconomics.com/9984:jp

IDC Research. (2025, September). Enterprise AI Operationalization Survey 2025.

https://www.idc.com/getdoc.jsp?containerId=prUS51234425

IEEE Spectrum. (2025, August 12). Securing time in AI systems — the next frontier.

https://spectrum.ieee.org/secure-time-ai

Financial Times. (2025, July 28). Telecom leaders on the AI transition.

https://www.ft.com/content/telecom-ai-transition

Bloomberg TV. (2025, October 2). Interview with Richard Windsor on AI valuations.

https://www.bloomberg.com/live

Crawford, K. (2025, May). Time and truth in AI economies. Nature Machine Intelligence, 7(5), 311–318.

https://www.nature.com/articles/s42256-025-00773-x

⚖️ © 2025 Betweenplays Media Inc™. All rights reserved.

Unauthorized reproduction or distribution of this publication is strictly prohibited.

All company names, tickers, and trademarks are property of their respective owners.

This publication reflects independent editorial research and analysis.

Betweenplays Media Inc™ — From the depths of hell, the bull is back. 🐂🔥