AI in the Dirt, Not the Pixels: The Invisible Alpha Behind the Physical Revolution

Why The Term “AI Bubble” Misses The Physical Revolution

— by Andrea Turno, Betweenplays Media Inc. Contributor and Author

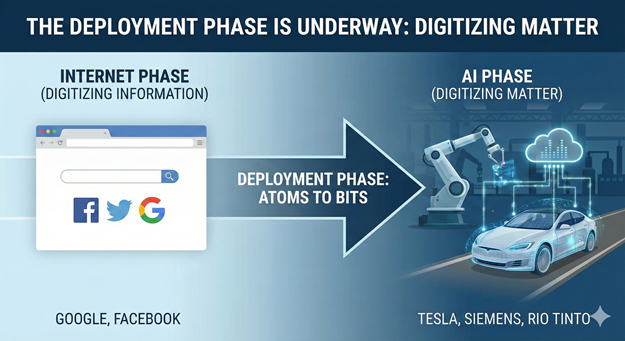

Wall Street remains fixated on the idea that artificial intelligence might be a bubble. Analysts point to elevated price–earnings ratios and ask how many $20 ChatGPT subscriptions it will take to justify trillion-dollar valuations. That critique only makes sense if your entire mental model of AI begins and ends with consumer applications—image generators, chatbots, and programming assistants. This is a view largely shaped by novelty rather than actual technological impact.

The real transformation, the one that is already reshaping balance sheets, cash flows, and capital allocation, is happening far from the consumer internet. It is unfolding in factories, on offshore platforms, across mining sites, inside water networks, and throughout national power grids. In these environments, AI is not generating content. It is generating yield. It is not solving conversation. It is solving physics.

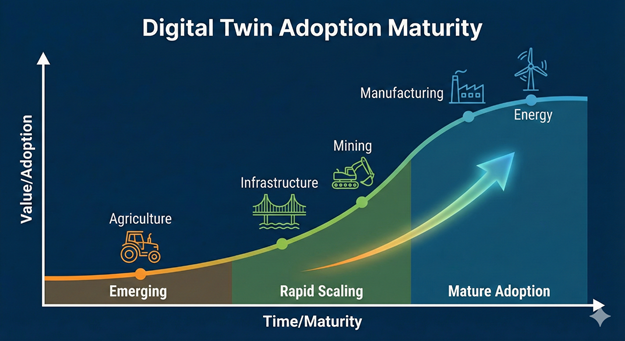

The public markets have priced the suppliers—NVIDIA, Microsoft, the cloud hyperscalers—at nearly impossible premiums. But they have not priced the users: the industrial operators deploying AI and simulation to transform physical assets into software-defined machines. That discrepancy is the opportunity. It is the Invisible Alpha—the unpriced performance advantage emerging at the intersection of Digital Twins and industrial AI adoption.

To see the mispricing clearly, one must understand what a Digital Twin actually is, what it does, and why it is redefining the economics of the physical world.

The Digital Twin: A Living, Predictive Model of Physical Reality

A Digital Twin is often conflated with 3D modeling or CAD visualization. In practice, it is far more significant and far more powerful. A true Digital Twin is a high-fidelity, continuously updated, physics-based virtual replica of a real-world asset—whether a turbine, factory, supply chain, water network, mine, or oil platform.

A genuine Digital Twin integrates:

Real-time bi-directional data flow. Sensors, cameras, telemetry, IIoT infrastructure, and SCADA systems continuously update the twin with operational data, while the twin pushes back optimizations, risk alerts, and predictive recommendations to the physical asset.

Physics-accurate simulation. Using platforms such as Siemens Xcelerator, Dassault Systèmes’ 3DEXPERIENCE, Ansys, and NVIDIA Omniverse, the twin models thermodynamics, structural behavior, flow dynamics, stress loads, and environmental interactions with engineering-grade precision.

AI-driven foresight. Machine learning models run millions of hypothetical scenarios inside the twin, stress-testing decisions and forecasting failures before they occur in the real world.

“The digital twin is rewriting how products are designed, manufactured and maintained.” – Siemens CEO Roland Busch (Siemens Annual Report, 2024)

A Digital Twin is not a tool. It is a cognitive layer for physical assets—effectively granting them a brain.

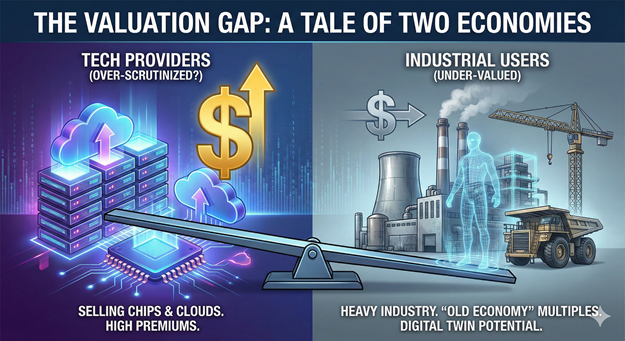

The Valuation Gap: A Tale of Two Economies

Currently, there is a stark disconnect in stock market evaluations:

- The Tech Providers (Over-Scrutinize): The “Magnificent 7” are trading at premiums because they sell the chips and clouds. Skeptics argue their growth is cyclical. They are wrong. The demand for compute to simulate the physical world (not just the internet) is structural and just beginning.

- The Industrial Users (Under-Valued): Companies in heavy industry (e.g., Deere, Caterpillar, Siemens, Eaton) are still largely trading on “old economy” multiples. The market views them as cyclical hardware businesses. It has not yet priced in their transition to high-margin, recurring-revenue software businesses powered by Digital Twins.

This is the Invisible Alpha: The moment a billion-dollar factory gets a Digital Twin, it ceases to be just a pile of steel. It becomes a data-generating asset that can self-optimize, predict its own maintenance, and achieve OpEx Deflation—a non-linear, structural reduction in costs that is the holy grail of industrial finance.

The Invisible Alpha: The Mispricing of Industrial AI

The Invisible Alpha is the widening valuation gap between two groups:

- Companies selling the AI infrastructure—GPUs, hyperscale clouds, simulation engines

- Companies using AI and Digital Twins to restructure physical operations into predictive, software-defined systems

Markets have aggressively priced the former. They have barely budged on the latter.

When an industrial asset becomes software-defined, yield expands, downtime collapses, planning accuracy improves non-linearly, and maintenance becomes predictive rather than reactive. Cash flow stabilizes, CapEx risk decreases, and operational leverage increases. But traditional valuation frameworks—built for analog, linear, hardware-constrained businesses—have not adjusted accordingly.

The Invisible Alpha is the delta between what these companies are worth in a software-augmented future, and how they are priced today.

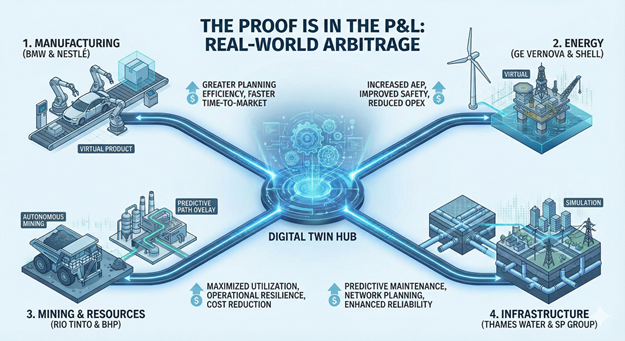

Proof in the P&L: Digital Twins Reshape Industrial Economics

Digital twins have moved from “innovation theater” to measurable operating leverage. When a plant, mine, grid, or fleet can be simulated in near real time—fed by sensor data, maintenance logs, and production constraints—decisions stop being theoretical and start showing up in the P&L: fewer unplanned outages, tighter throughput, lower energy intensity, faster commissioning, and smarter capex timing. The economics are not abstract; they understand waste, downtime, and variance. The following companies show where digital twins are already converting operational complexity into margin, resilience, and speed.

Manufacturing: BMW & Nestlé

BMW’s “iFACTORY” initiative has digitally replicated all 31 of its global production plants, allowing every new model to be assembled virtually thousands of times before the first physical unit is built. According to Milan Nedeljković, BMW’s Head of Production:

“Virtual simulation is becoming the cornerstone of our production system.”

(BMW Press Release, 2023)

This shift has delivered a 30% improvement in planning efficiency and dramatically reduced stoppage risk.

Nestlé, meanwhile, uses NVIDIA Omniverse-powered Digital Twins to generate packaging and global content at unprecedented speed. As Global CMO Aude Gandon notes:

“Digital twins help us accelerate content creation at scale for our global brands.”

(Packaging Europe, 2023)

Tasks that once took weeks can now be completed in minutes.

Energy: GE Vernova & Shell

GE Vernova operates “Digital Wind Farms” where each turbine continuously simulates and optimizes blade pitch and energy capture.

“Digital twins provide operators with the insight to optimize performance and reduce unplanned downtime.” (GE Vernova, Wind Services)

Shell leverages Digital Twins to monitor and maintain offshore platforms—reducing on-site risk and improving asset reliability.

“Digital twins are enhancing the way we design, build and operate energy assets worldwide.” (Offshore Energy, 2023)

The result is higher availability, safer operations, and significant OpEx savings.

Mining: Rio Tinto & BHP

Mining is becoming increasingly autonomous—and Digital Twins are central to the shift. Rio Tinto operates one of the world’s largest autonomous haulage fleets using predictive modeling.

The impact:

“Automation and digitalization are transforming the safety and productivity of our operations.” – Rio Tinto CEO Jakob Stausholm (Rio Tinto Annual Report, 2024)

BHP uses Digital Twins to simulate crushers, processing lines, and haul routes, enabling predictive maintenance and optimized throughput.

“Digital twins are now central to decision-making across our mining operations.”– CTO Laura Tyler(BHP Insights, 2025)

These technologies are reshaping unit costs and safety across the sector.

Infrastructure: Thames Water & SP Group (Singapore)

Thames Water has built a Digital Twin of its entire pipe network to predict leaks before they occur. Strategy Lead John Russell states:

“Digital twins allow us to predict failures before they happen and target our investments effectively.” (Thames Water Innovation)

In Singapore, SP Group and the Energy Market Authority developed a Digital Twin of the national power grid—modeling EV adoption, renewables intermittency, and distribution loads.

“A major step towards ensuring a future-ready and reliable grid for the nation.”

(EMA, 2021)

These systems shift infrastructure from reactive maintenance to proactive stewardship.

The Physics Layer: The New Industrial Operating System

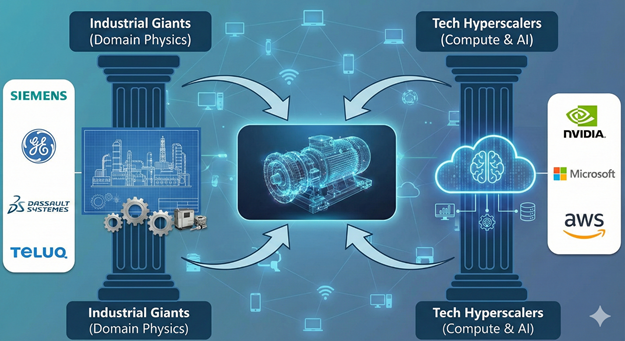

The deeper moat in industrial AI does not belong only to the GPU makers—it belongs to the simulation engines, physics platforms, and middleware controlling the digital reconstruction of physical reality.

The “Arms Dealers”: Who Owns the Physics?

If the users are undervalued, so too is the “second layer” of technology providers. The market focus is entirely on the GPU (NVIDIA). However, the software platforms that host these physics-based simulations are the operating systems of the future industrial world.

- The Simulation Engines: Companies like Unity and Dassault Systèmes (3DEXPERIENCE) hold the intellectual property for the “physics engines” that make twins accurate. As physical AI scales, their software becomes as essential as the factory electricity supply.

- The Industrial Metaverses and Edge Compute: NVIDIA’s Omniverse platform is misunderstood as a graphics tool; it is the industrial simulation standard—the place where robots learn to be robots before they are built. Crucially, the AI models are increasingly running on the asset itself (Edge AI), enabling real-time, autonomous decisions (like a self-adjusting turbine blade) without cloud latency.

- The Domain Experts & Middleware: Companies like Siemens (Xcelerator), Bentley Systems (iTwin), and AVEVA own the domain knowledge of how things are built and the crucial Industrial IoT (IIoT) middleware that manages and unifies the billions of data points streaming from assets. They are the gatekeepers of the data required to build the twins.

“Omniverse is the operating system for industrial digitalization.” – Jensen Huang CEO (NVIDIA GTC Keynote)

Deployment, Not Bubble

The argument that AI is a bubble evaporates when viewed through the lens of industrial adoption. This is not speculative. It is operational. It is financial. It is structural.

The “AI Bubble” narrative assumes that AI is a consumer product. It misses the reality that AI is an industrial process. For the astute investor, the opportunity lies in identifying the “Old Economy” giants that are aggressively deploying Digital Twins to decouple their growth from their physical footprint.

The smart money isn’t just buying the chip makers. It’s buying the future leaders of the Physical AI revolution—the companies that are turning atoms into bits, and bits into high-margin, recurring profits.

McKinsey quantifies the impact clearly:

“Companies using digital twins can improve revenue by up to 10% and accelerate time-to-market by as much as 50%.” (McKinsey, The State of AI, 2025)

The Invisible Alpha rests with the companies treating physical assets as intelligent, predictive software systems—and with the investors who understand that the value creation is only beginning.

When assets begin to think, they become more efficient through mapping and automation. This means that margins follow. And when that happens, valuations inevitably follow.

The internet digitized information. AI is digitizing matter.

The future of AI is not in the pixels; it lives in physical reality, and ultimately in the dirt below our feet.

References

Bentley Systems. (n.d.). iTwin platform. https://www.bentley.com/software/itwin-platform/

BHP. (2025). The role of digital twins and AI in enhancing decision-making in the mining industry. https://www.bhp.com/news/bhp-insights/2025/02/the-role-of-digital-twins-and-ai-in-enhancing-decision-making-in-the-mining-industry

BMW Group. (2022). This is how DIGITAL the BMW iFACTORY is. https://www.bmwgroup.com/en/news/general/2022/bmw-ifactory-digital.html

BMW Group. (2023). Virtual simulation becomes cornerstone of production [Press release]. https://www.press.bmwgroup.com/global/article/detail/T0437987EN

Deloitte. (2023). From manufacturing to medicine: How digital twins can unlock new industry advantages. https://www.deloitte.com/us/en/insights/topics/business-strategy-growth/digital-twin-strategy.html

Energy Market Authority. (2021). Singapore’s first digital twin for national power grid. https://www.ema.gov.sg/news-events/news/media-releases/2021/singapores-first-digital-twin-for-national-power-grid

GE Vernova. (n.d.). Wind services. https://www.gevernova.com/wind-power/services

McKinsey & Company. (2025). The state of AI: Agents, innovation, and transformation. https://www.mckinsey.com/capabilities/quantumblack/our-insights/the-state-of-ai

Nestlé. (2023). Digital twin service redesigns packs for new formats and campaigns. Packaging Europe. https://packagingeurope.com/news/nestles-digital-twin-service-redesigns-packs-for-new-formats-and-campaigns/12961.article

NVIDIA. (n.d.). Omniverse. https://www.nvidia.com/en-us/omniverse/

Rio Tinto. (2024). Annual report 2024. https://www.riotinto.com/invest/reports/annual-report

Shell. (2023). Shell leveraging Swiss digital twin technology to optimize global offshore assets. Offshore Energy. https://www.offshore-energy.biz/shell-leveraging-swiss-digital-twin-technology-to-optimize-global-offshore-assets/

Siemens AG. (2024). Annual report 2024. https://www.siemens.com/global/en/company/investor-relations/annual-report.html

SP Group. (2021). Singapore’s national grid digital twin initiative. https://www.ema.gov.sg/news-events/news/media-releases/2021/singapores-first-digital-twin-for-national-power-grid

Thames Water. (n.d.). Unlocking digital twins. https://www.thameswater.co.uk/about-us/innovation/unlocking-digital-twins

VanEck. (2024). Is AI a bubble? The Dot-Com bubble vs. today’s AI revolution. https://www.vaneck.com/us/en/blogs/thematic-investing/is-ai-a-bubble-the-dot-com-bubble-vs-todays-ai-revolution/