🎙️ Betweenplays Media™ — Not Financial Advice

How Quantum Computing, AI, and Upgradable Cryptography Will Redraw the Entire Blockchain Crypto Landscape, Understanding the Quantum Threat to Bitcoin.

For over a decade, Bitcoin has been treated as the unshakeable fortress of digital value — a mathematically pure asset with no CEO, no board, and no centralized authority to alter its protocol. It was designed to be incorruptible.

But Quantum Computing + AI is now challenging that assumption in a fundamental and irreversible way.

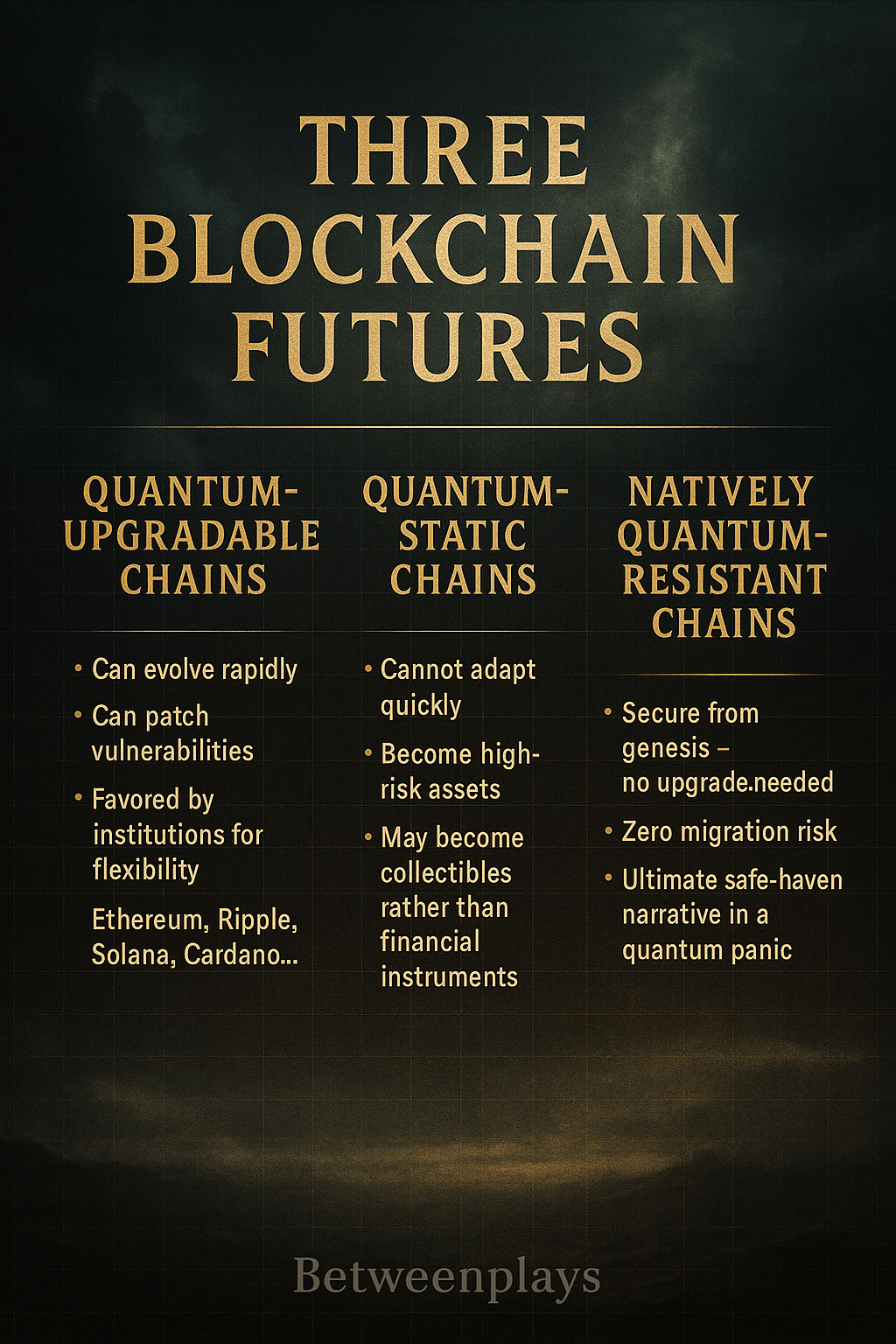

And the crypto world is about to split into three classes:

- Blockchains that can adapt to quantum threats (governed/upgradable).

- Blockchains that cannot change without community miracles (purely decentralized/static).

- Blockchains that were built quantum-resistant from day one — no upgrade required.

This divide is not theoretical anymore — it’s becoming the defining risk vector of the next decade.

⸻

Here are things to look for in the next cycle. When it comes to the quantum threat.

A: Why Bitcoin Was “Unhackable” — Until Now

B: Major Altcoins

Ethereum:

Vitalik Buterin has repeatedly emphasized quantum resistance as a long-term roadmap priority (e.g., in 2025 Devconnect talks), targeting preparation by ~2028–2030. It’s part of “The Splurge” or future phases, but full migration is described as taking years due to coordination across L1, L2s, wallets, and dApps. No “instant” switch exists — even hard forks like Dencun or Pectra take 6–18 months of planning/testing.

Ripple/XRP Ledger:

Ripple’s CTO David Schwartz stated in early 2025 that quantum resistance isn’t urgent yet, as current PQC isn’t well-suited for blockchain scale. Some reports mention ongoing research into hash-based or lattice-based upgrades, but no deployed mechanism allows instant reaction. The XRPL’s consensus model is fast for amendments, but a full crypto migration would still require proposal, voting, and ecosystem-wide updates.

– General estimates for major chains: Papers and analyses (including NIST migration guidance) peg realistic timelines at 4–8+ years for full transitions, even with proactive teams.

C:: Natively Quantum-Resistant Blockchains

There is another category that doesn’t need to “react” at all: projects designed from genesis to withstand quantum attacks.

⸻

If Bitcoin, Ethereum, Ripple, and others perform rapid quantum upgrades, they gain:

- Market confidence

Investors follow the safest asset. - Government and institutional approval

Banks, CBDCs, and enterprise blockchain rely on security guarantees, not ideology. - Rise in adoption

Upgradable blockchains become the preferred infrastructure. - Value rotation

Capital rotates out of unprotected chains into adaptable networks. - New narrative

“Upgradable, quantum-secure blockchains” becomes the dominant investment thesis of the late 2020s.

Addendum: The Rise of Natively Quantum-Resistant Tokens

A sleeper narrative for the next cycle is pure quantum-resilient tokens and projects.

- Already secure — no future upgrade risk

- Built on hash-based, NIST-approved cryptography from day one

- Acts as “quantum insurance” in portfolios

- Low market cap today → asymmetric upside when quantum headlines hit

- Positions itself as the true “post-quantum digital gold” — immutable, scarce, and unbreakable even if every other chain panics

In a world where quantum breakthroughs trigger FUD rotations, those networks could see explosive inflows as the ultimate hedge.

⸻

Quantum-Upgradable Chains

- Can evolve rapidly

- Can patch vulnerabilities

- Favored by institutions for flexibility

- Examples: Ethereum, Ripple, Solana, Cardano…

Quantum-Static Chains

- Cannot adapt quickly

- Become high-risk assets

- May become collectibles rather than financial instruments

Natively Quantum-Resistant Chains

- Secure from genesis — no upgrade needed

- Zero migration risk

- Ultimate safe-haven narrative in a quantum panic

⸻

Final Conclusion:

Bitcoin was invincible in the classical world.

Quantum computing changes the physics of security.

- Blockchains with governance (Ethereum, Ripple, Polkadot, Solana…) → survive, adapt, and strengthen.

- Blockchains without governance (Bitcoin) → face the greatest existential risk.

- Blockchains built quantum-resistant from the start → emerge as the quiet winners, potentially capturing the “unbreakable store of value” mantle in the post-quantum era.

If any blockchain cannot upgrade in time of the q day, when quantum computing can hack its blockchain, capital will flow to the survivors — and the purest quantum-resilient tokens could become the biggest surprises of the next bull cycle.

That is the quiet truth the industry has been avoiding — and the biggest storyline of crypto’s next decade.

Just my two cents on this. Crypto so far has always been cyclical and driven by a different narrative every cycle.

But hey maybe THIS time it’s different.

SOURCES:

| Deloitte — “Quantum risk to the Ethereum blockchain” | Explains how quantum computing threatens major blockchains (cryptography underlying them), and what remediation / transition to quantum-safe would entail. Deloitte |

| National Institute of Standards and Technology (NIST) — Post-Quantum Cryptography Standards 2024 | Confirms that PQC algorithms are now being standardized globally — key piece to your “natively quantum-resistant / post-quantum” angle. NIST+2NIST Computer Security Resource Center+2 |

| Chainalysis — “Quantum Computing and Cryptocurrency” (2025 blog piece) | Provides a sober industry-analysis view: quantum risk is real but with a likely 5–15 year timeline. Useful to counter “alarmist but unrealistic” criticisms. Chainalysis |

| BTQ Technologies — Press release (Oct 16, 2025) about a quantum-safe Bitcoin implementation | Concrete example supporting your narrative: quantum-resistant upgrade to Bitcoin is already being demonstrated. PR Newswire+1 |

| Academic survey “Literature Review of the Effect of Quantum Computing on Cryptocurrencies” (2025) by Adi Mutha & Jitendra Sandu | Gives a broad, scholarly foundation: shows that many blockchains (including Bitcoin, Ethereum, etc.) are vulnerable to quantum threats under current cryptographic assumptions. arXiv |

| Recent 2025 research “Impact of Quantum Computing on Blockchain and Decentralized Application Security” | Highlights not only signature-scheme vulnerabilities, but also structural risks to consensus, dApps, smart-contract & blockchain integrity under quantum scenarios. ResearchGate |

ADVERTISMENT