In a rare all in buy in alert Tesla signs with Talon Metals for Nickel!

Terms of the deal are as such, taken from Talons website and PDF will be included here.

Agreement Highlights:

- Under the terms set out in the agreement, Tesla has committed to purchase 75,000 metric tonnes (165 million lbs) of nickel in concentrate, representing a portion of the metals projected to be produced from the Tamarack Nickel Project. Tesla also has a preferential right under the agreement to negotiate the purchase of additional nickel concentrate over and above the initial 75,000 metric tonne commitment.

- The term of the agreement is six (6) years or until a total of 75,000 metric tonnes (165 million lbs) of nickel in concentrate has been produced and delivered to Tesla. The agreement is conditional upon: (i) Talon earning a 60% interest in the Tamarack Nickel Project; (ii) Talon commencing commercial production at the Tamarack Nickel Project; and (iii) the parties completing negotiations and executing detailed supply terms and conditions. Talon will use commercially reasonable efforts to achieve commercial production on or before January 1, 2026 at the Tamarack Nickel Project, which may be extended by the agreement of the parties for up to 12 months following which Tesla has a right to terminate the agreement and Talon may elect to sell to other parties.

- Talon and Tesla will work together to optimize nickel concentrate grades and metal recoveries.

- The purchase price to be paid by Tesla for the nickel in concentrate will be linked to the London Metals Exchange (LME) official cash settlement price for nickel. The parties have also agreed to share in any additional economics derived from by-products extracted from the nickel concentrate, such as iron and cobalt.

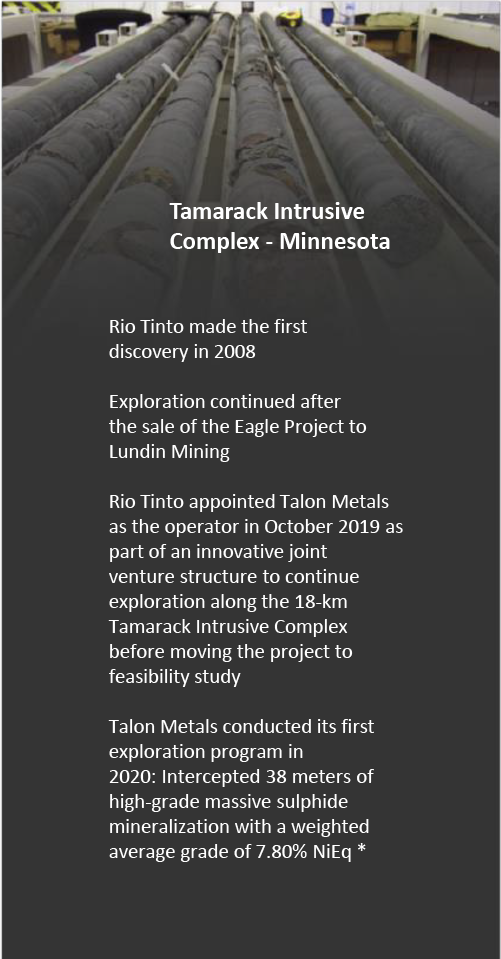

There’s also the Joint Venture with none other than giant RIO TINTO which plays out in this manner:

Talon-Rio Tinto Deal Structure

- The Tamarack Project is comprised of the Tamarack North Project and the Tamarack South Project with approximately 31,000 acres of Private Land and State Leases

- Talon has formally earned a 51% majority interest in the Tamarack Nickel Project by:

- Paying US$6 million in cash and US$1.5 million in shares to Rio Tinto (completed in March 2019);

- Spending US$10 million on exploration & development and issuing an additional US$5 million in Talon shares to Rio Tinto (completed in September 2021)

- To earn an additional 9% interest for a total of 60% (by March 2026), Talon must complete a feasibility study and pay US$10 million to Rio Tinto

- Under the Option Agreement, Talon is appointed as the operator of the Tamarack Project, with total control over future exploration strategy

- After Talon owns 60%, Rio Tinto must fund their 40% interest, or dilute; Rio Tinto has no back-in rights; Talon controls 100% of the off-take (to whom the product is sold)

But what really gets me going (besides the Tesla deal is the fact two other mines of high quality Nickel of this sort is set to run out of Nickel in the near future!

Talon Metals is also very community friendly and really green, exactly what Elon Musk was looking for form their website here!

GREEN NICKEL

FOR A U.S. SUPPLY CHAIN

TALON METALS CORP

GREEN NiCKEL

HIGH GRADE = SMALL FOOTPRINT

NICKEL FROM MINE TO BATTERY IN THE USA

• NO TAILINGS DAM

GREEN ENERGY FOR AN ELECTRIC MINE FLEET

CARBON CAPTURE AND STORAGE

COMMUNITY DEVELOPMENT: SUPPORTING SUSTAINABLE GROWTH BEFORE, DURING. & POST-MINE CLOSURE

“Tesla will give you a giant contract for a long period of

time if you mine nickel efficiently and in an

environmentally sensitive way

-Elon Musk (July 23, 2020)

(Co-founder and CEO of Tesla)

Now we have some of that information let us look at the EV Nickel demand by 2029, Nickel will need to be doubled to ensure sustainability, with mines closing and those other type called laterites which we know have been dumping their tailings into the Indian Ocean which contribute to the destruction of our planet, these explanations below come from Talons website.

Ni Demand for EV

- Nickel demand for the lithium-ion battery supply chain is expected to grow to 1.26mt in total by 2029

- This is 6.4x what was used in 2019

- This means that the total 2019 nickel production suitable for the battery supply chain has to double

In conclusion:

Talon has what Tesla needs and what EV manufacturers need, with a great deposit and more expansion to come Talon is the future of sustainable Nickel and its of my opinion that Talons share price won’t be at 0.70$ in years to come.

Join our Facebook Betweenplays Stockmarket Strategies Group

https://www.facebook.com/groups/408846957166055

Talon Metals on Yahoo finance:

https://ca.finance.yahoo.com/quote/TLOFF?p=TLOFF

Talon Metals Website:

Join Betweenplays Stockmarket Strategies Facebook group with over 1200 members bringing you all types of Stockmarket information from our members as well as Betweenplays picks!

https://www.facebook.com/groups/408846957166055

Legal Disclaimer:

Betweenplays Stockmarket Strategies is an entertainment educational medium, what we put up is our opinion and we are not certified financial analysts, please seek a professional analyst if you need help with your finances or investments. We are not responsible for anyones losses as this is a blog created to entertain and of our own use, please take the time to research, prepare-plan execute on your own investment style after you have done your own due diligence, stay strong!