This is a paid promotion, Betweenplays has a contract with First Phosphate and own shares in the company.

Betweenplays is thrilled to share with you the positive outcomes of First Phosphate Corp.’s recent assessment of the Lac à l’Orignal Property in Quebec, Canada.

This analysis holds significant implications and I’m here to delve into the key insights for you.

First Phosphate Corp. (CSE: PHOS) (OTC Pink: FRSPF) (FSE: KD0), a prominent player in mineral development, has just disclosed the compelling findings of its Preliminary Economic Assessment (PEA) on the Lac à l’Orignal Property.

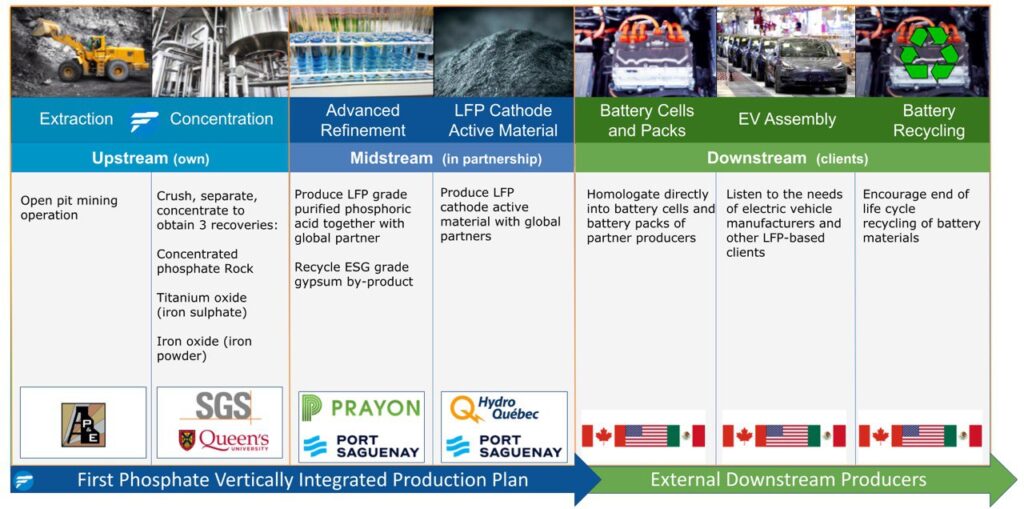

Betweenplays understands the importance of aligning investments with strategic ventures that show potential for growth. In this case, First Phosphate’s focused mission revolves around the extraction and purification of phosphate, a critical component for producing cathode active material used in Lithium Iron Phosphate (LFP) batteries, a sector witnessing substantial demand growth.

CATL says its new fast-charging battery can add 250 mi in 10 min

Of particular interest is the assessment’s indication of the property’s viability for open pit mining. This approach sets the stage for primary phosphate concentrate production, complemented by the recovery of magnetite and ilmenite concentrates. The implications are diverse, encompassing economic advantages for the company as well as potential positive outcomes for the neighboring communities.

One remarkable highlight of the assessment is the projected annual production. Envisioned is an average of 425,000 tonnes of beneficiated phosphate concentrate, boasting a content of over 40% P2O5. Moreover, the projection includes the production of 280,000 tonnes of magnetite and 97,000 tonnes of ilmenite over a mine life spanning 14.2 years.

The pre-tax internal rate of return (IRR) at 21.7% and the pre-tax net present value (NPV) of a substantial $795 million, considering a 5% discount rate, are robust indicators of the project’s potential profitability. Post-tax, the project maintains its appeal with an after-tax IRR of 17.2% and an after-tax NPV of $511 million. Additionally, the projected after-tax cash flow of $567 million during the initial 5 years of production suggests an expedient payback period of 4.9 years.

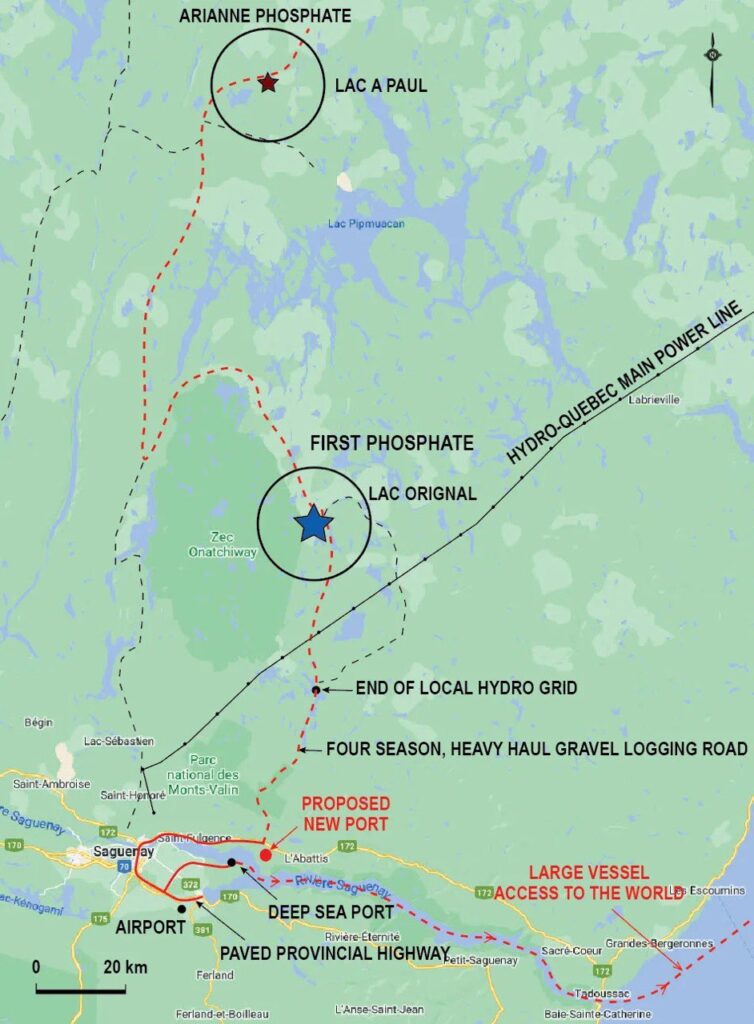

In assessing investment opportunities, infrastructure plays a pivotal role. The property’s strategic location offers the advantage of proximate road access, electrical power lines, and a year-round accessible deep-sea port, the Port of Saguenay, facilitated via a four-season road.

The assessment’s calculations are grounded in Indicated and Inferred Mineral Resources, a crucial consideration when gauging the project’s investment potential. Furthermore, the absence of existing royalties or financing obligations adds to the project’s attractiveness and economic feasibility.

Operationally, the mining methodology encompasses conventional truck/shovel open pit techniques. This involves employing 90-tonne capacity haulage trucks and shovels equipped with 10 cubic metre buckets. With a projected timeline spanning 14.2 years of production and one year of pre-stripping, the plan ensures that mineralized materials are efficiently transported to the process plant, while waste rock is appropriately managed.

A pivotal aspect of any investment assessment is the project’s technical feasibility and economic sustainability. In this context, metallurgical testing conducted at SGS, Quebec City, yields promising recoveries for phosphate, magnetite, and ilmenite, bolstering the project’s potential for favorable financial outcomes.

Prized Igneous Anorthosite Rock Phosphate

1% of the world’s cleanest source of phosphate rock from igneous anorthosite

Devoid of heavy metals and very low sulphur

Produces large amounts of LFP battery grade advanced phosphate material with less resources

Recognizing the significance of community relations, First Phosphate Corp. actively engages with the Indigenous communities in the vicinity.

At Betweenplays, we acknowledge the value of inclusive and responsible ventures. The company’s respect for the traditional rights of the Mashteuiatsh, Essipt, and Pessamit First Nations demonstrates a commitment to ethical engagement and ensures the inclusion of community perspectives in the decision-making process.

https://ca.finance.yahoo.com/news/first-phosphate-announces-positive-results-123500862.html

The potential for economic growth, coupled with a focus on sustainability, strategic partnerships, and community integration, positions First Phosphate as a compelling venture within the realm of mineral development within the evolving demands of the Lithium Iron Phosphate battery industry.

BETWEENPLAYS STOCKMARKET STRATEGIES