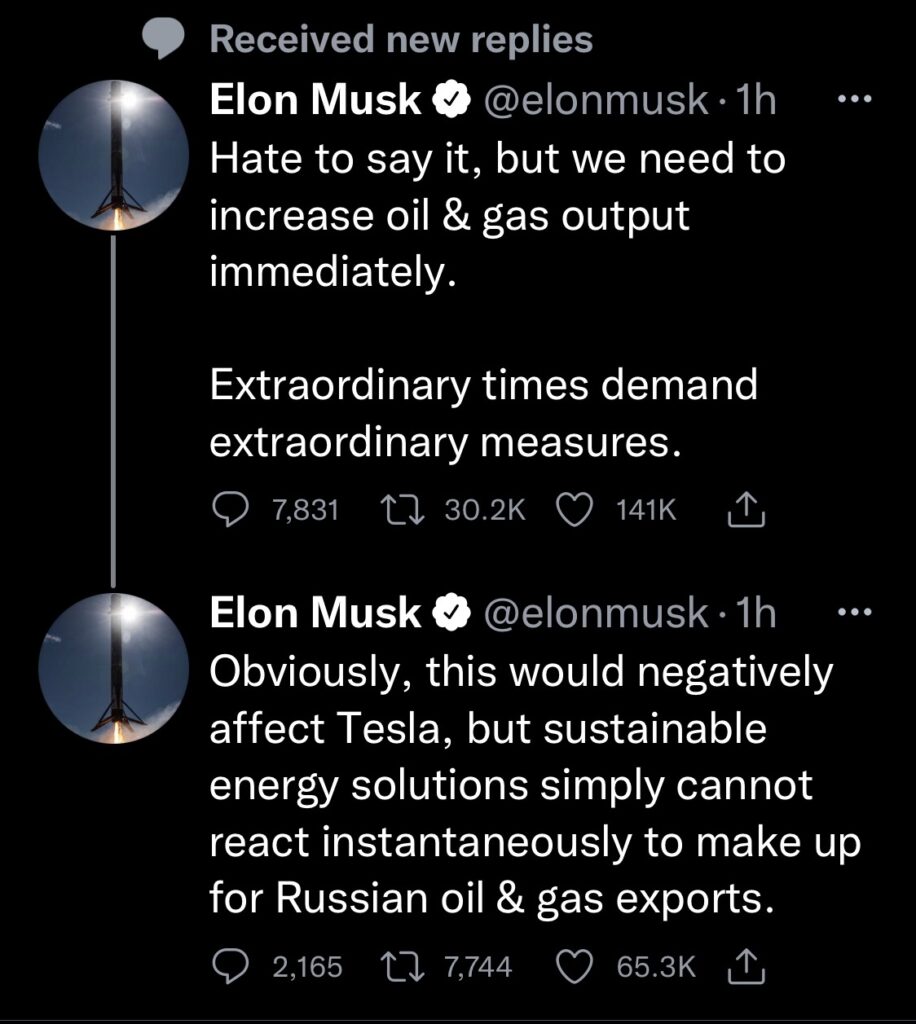

Never forget the era you are living in, the distant past is an indicator of a repeating future, a cycling of sorts, the recent past and the near future are transitionary, look at the times, look at the Macroeconomic environment then take a hard long look at the the needs of the people on a Microeconomic level and you will find where your money should go in terms of “Investment Opportunities”; Elon Musk of all people stated we need to produce more oil (think about that Elon Musk said we need more oil), it is a fact we need to produce more oil locally because of world politics, take the Ukraine-Russia conflict with UN countries placing sanctions on Russia including its oil exports.

What do you think that means for Critical Rare Earth minerals which mainly come from Russia and China, it means the same thing, we need to produce more and in some cases not only more but we need to explore, find, mine to produce period because in some cases, we don’t produce nor have searched for such minerals.

In a not so distant past around 2009-2010 we started seeing how important rare earth minerals could affect other countries as China used its rare earths to affect Japan at that time.

More recently and in the present we have issues concerning the rare earth minerals coming out of china but in relation to the USA, most of the rare earths come from China, but China stated they would not be exporting any because of the covid situation which left the USA in a bad state, then the USA took its stance on the situation, this led to the increased understanding that China, as they did to Japan in 2010, could easily do to us, a rare earth importance in the stock market took a direct hit as the USA was the affected party this time around, this led to the signing of documents between Canada and the USA to secure Rare Earth Minerals in February 2021.

Don’t miss opportunities when it comes to rare earth minerals, if we look at the world today compared to last 30 years, the world is no longer the same, we are entering an era of three gigantic world powers with others on the way up, the big producers of Russia and China are making it so that if we do not produce rare earth minerals, we will be in a dire situation, as much as Elon Musk calling out for more local oil production, we need to secure sustainable minerals such as scandium!

In comes Imperial Mining Group, ($IPG.V – $IMPNF) out of Quebec Canada with a huge finding of the Critical Rare Earth Mineral named scandium, Imperial Mining Group was recently awarded 245,355$ grant to optimize its Crater Lake, Quebec locally mined, scandium recovery phase, now this isn’t just a small thing here, this grant is to support exploration and development highly important critical and strategic minerals and related to a four year 4.25 million support program; this will aid in the study started in January 31 2022 and end in Q3 2022, this will aid in the engineering design of Imperials Pilot Plant.

Just as recent as December 7th 2021 Imperial intersects new zone return of 115.8 m of Scandium rare earth mineralization on top of their already 7.3 million tons indicated resource and 13.2 million tons inferred resource as described in Novembers 5th 2021 press release under the 43-101 technical report, the minimum threshold resource of 20 to 25 years of mining operation exceeds that minimum over 10 million tons, Imperials base assumption would be to produce 50 to 100 tonnes per year of high purity scandium, the area is still open at length depth which means there is potential to increase the deposit in this one area!

In addition, Imperial Mining Group plan to construct an aluminum scandium master alloy plant, add that to the partnership with Eck Industries we have the potential here to be the lead producers for North America and with the USA and Canada in need to lock up Rare Earths, Imperial looks to be in a very lucrative spot, I highly advise readers to look at their investors presentation here!

Imperial Mining Group has on hand one of the World’s largest primary scandium resource!

So when I’m investing I always look at the Macroeconomic Environment, the CAGR potential of an Industry, then the Microeconomics, Financials of a company, it all starts with what service or product they are selling, its rarity or how high the barrier to entry is, the more difficult it is for competitors to get into, the more interested I get.

Scandium is mostly produced in Russia and China, has made the American list of Critical Rare Earth Minerals. If you still don’t think its a big deal, it might have taken time, but go look at the backlash on Neo Lithiums’ sale to a Chinese company recently, the retail investors were not happy nor was the American Government! Canada and the USA had signed a deal in early 2020 and we allowed a sale of an amazing lithium company and the USA Government is not happy, but what does that mean for Imperial Mining Group, a lot…it puts this company in a very locked in sector with high importance and we are in real real early, just where I want to be, (click here for Canada and US deal)!

When I look into a company, I also look into the management and what we have here in Imperial Mining Group is a qualified team of individuals that has done exploration and brought exploration companies to development. What else does the company have going for them; Founder, President and CEO of Imperial Mining Group Mr Peter Cashin!

Peter Cashin

Founder, President and CEO of Imperial Mining Group Peter Cashin a geologist with over 38 years of experience in the Mining Industry, Past-President and CEO of Quest Rare Minerals, discovered the world-class Strange Lake Rare Earth deposit, won the 2010 Quebec Prospector Of the Year Award, has discovered a substantial world class hard rock scandium deposit.

We had the chance to interview Mr. Cashin Founder, President and CEO of Imperial Mining Group, I highly suggest you click the icon and listen to the Interview!

Mr, Cashin took Quest from 0.06 cents to 9$ after China blocked rare earth minerals, we saw in that we could no longer rely on China as a supplier; Founder President and CEO of Imperial Mining Group Mr Peter Cashin has done it once again and banking on this fairly recent find in the Critical Rare Earth Sector at Crater Lake, scandium, but what is scandium.

An absolute must listen for any serious investor. Do not forget to follow us on Spotify and YouTube for more CEO interviews and follow ups on IPG.V

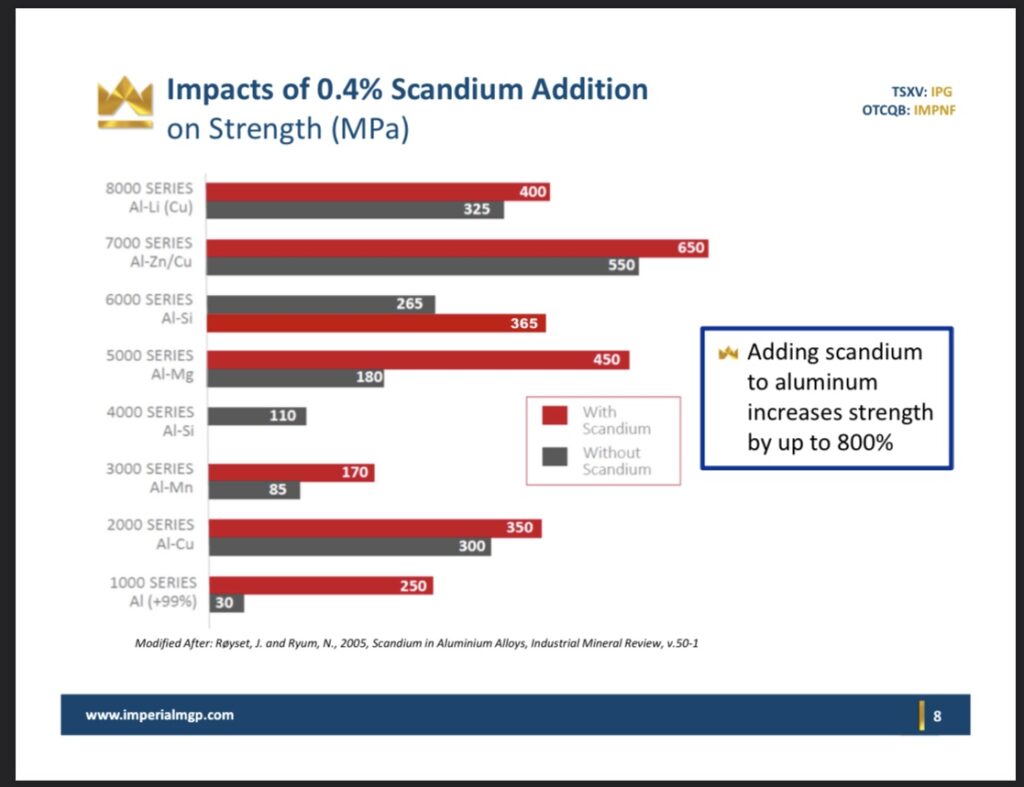

Scandium is a very rare, critical and important mineral, used in small quantities scandium can increase the strength of aluminum, the amount of scandium that needs to be used is very small but its impact is easily recognizable even to a simple layman, the Quebec Government decided to get involved in the action and as little as 0.2 to 0.4% is needed to increase aluminums strength 800%!

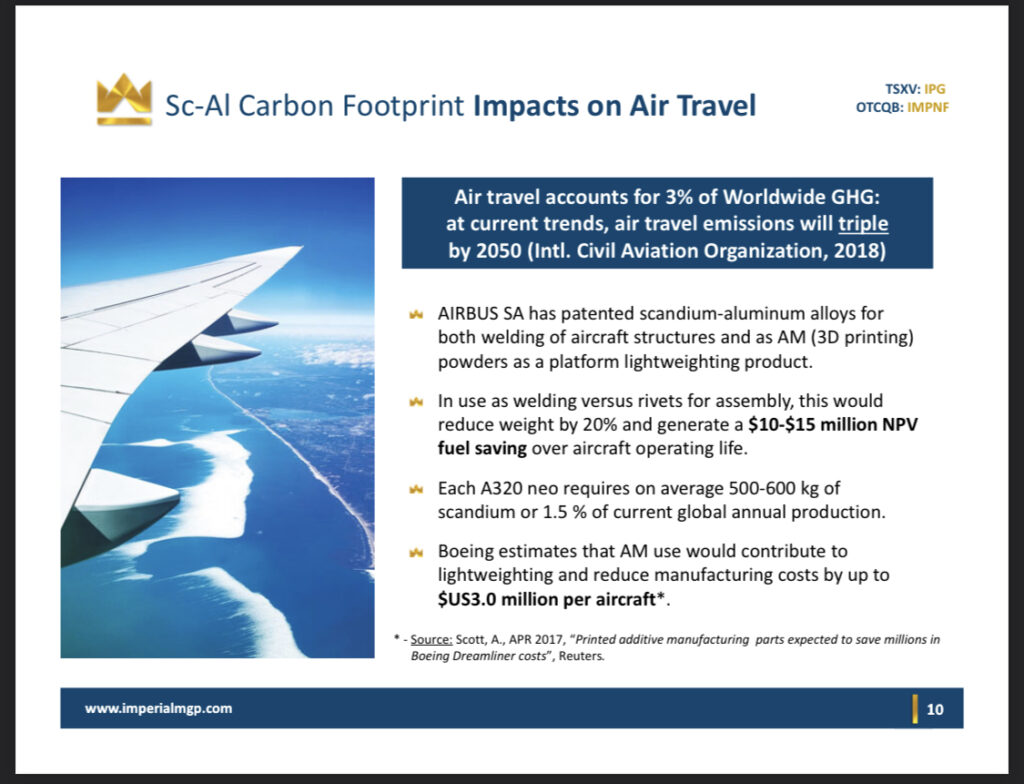

This is huge when it comes to the Defense sector in general like tanks and jets but it is also highly important to the commercial Aviation Industry too as we can make planes lighter by eliminating the rivets, the scandium increases the strength exponentially which allows the aluminum to be laser welded, this reduces the weight of the aircraft and therefore the costs, anything heavier will force the engine to increases torque and therefore translate into a high waste of oil-gasoline combustion or deplete electric planes of its energy quicker and slow down the vehicle in question and lose maneuverability…if we look to the future of aviation and head into electric planes, scandium in my opinion will be a necessity for companies looking to make planes as light as possible therefore a need for scandium exists in the past, present and more so in our future for companies like Eviation in the Aviation more specifically Electric Aviation Industry.

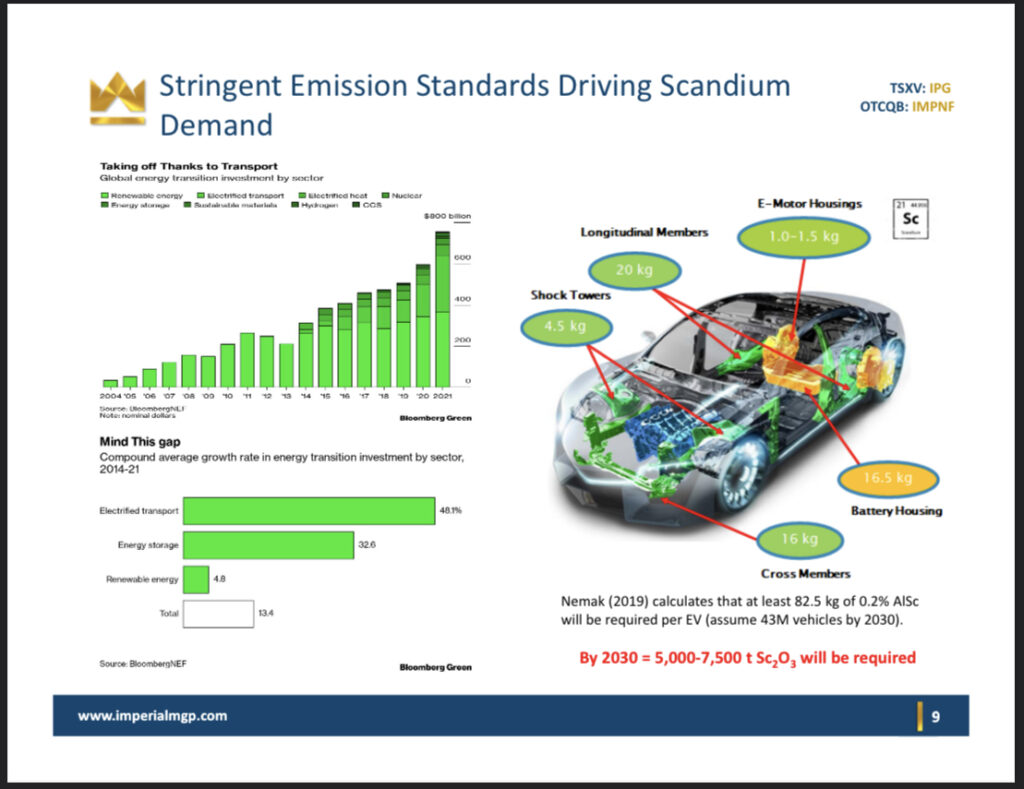

This also means that certain areas of planes will need other parts to be reduced in weight as well and not only the hull, a great example of this can be viewed in scandiums ultra importance in the automotive industry, mostly the electric vehicle revolution!

As for planes, Electric Vehicles will highly benefit from scandium as well as Fuel Cells making them stronger, lighter increasing range and more durable, let us not forget non corrosive! As with planes, there are parts that weigh more then they need to, these issues need to be brought into our era, for example, new breakthroughs in casting of battery housing, cross members, E-motor housing, shock towers are some examples and these are areas where Imperial Mining Group is working on problem solving solutions and not only are they working on them but have already come up with answers and let us not forget the importance that scandium plays in Fuel Cell Technology, heres an earlier presentation dating to June 2021 from Imperial I thought was interesting to look at!

Working with Eck Industries, Imperial Mining Group have built the first aluminum light weight, non corrosive and super strong EV battery box, this is a breakthrough with the casting company, we can just imagine the possibilities to come and let us not over look how scandium has had a recent breakthrough replacing Indium in solid state batteries for scandium. Here is a very interesting article from CleanTechnica, but I’ll copy paste some of the finer points below:

As described by JCESR, the typical solid-state battery chemistry focuses on sulfides, but that involves a complex ripple effect on battery design to prevent degradation above 2.5 volts. The conventional workaround involves coating the cathode material.

Refocusing the chemistry on a chloride electrolyte was part of the solution for Nazar group. JCESR notes that approach has been tried by other researchers, but Nazar’s group came up with a unique twist.

“The decision to swap out half of the indium for scandium based on their previous work proved to be a winner in terms of lower electronic and higher ionic conductivity,” JCESR explains.

“There is no indium production in the United States. China controls between 43% and 66% of the world’s indium reserves,” ACS adds.

Interesting! From the USA’s perspective, the situation looks not much better for scandium. According to the Royal Society of Chemistry’s latest data, the largest producers are China, Russia, and Malaysia, though the US is among the top three reserve holders. For the record, China tops the RCS’s list of reserve holders, followed collectively by Russia and the Commonwealth of Independent States, which includes Armenia, Azerbaijan, Belarus, Georgia, Kazakhstan, Kyrgyzstan, Moldova, Tajikistan, Turkmenistan, Uzbekistan, and of course Ukraine.

The US Geological Survey also strikes a gloomy note regarding domestic production of scandium in the US. As of 2019, the principle source for domestic use was China, though they list some production capability at facilities in Iowa, Arizona, and Illinois.

“Although global exploration and development projects continued in anticipation of increased demand, the global scandium market remained small relative to most other metals,” USGS concluded.

Somebody better step up their game, and quick. If solid-state battery makers want to get their hands on more scandium, they’ll have to fend off competing users including that “other” electric vehicle technology, solid oxide fuel cells.

https://cleantechnica.com/

Concerning fuel cells, I’ll leave you with a link explaining exactly what a fuel cell is here, Imperial Mining Group scandium is necessary for fuel cells which is on the rise across more than one industry, naturally there is the Fuel Cell Electric Vehicle (FCEV) industry, but there is more technology on the rise we need to look at, for one, look at Bloom Energy that uses fuel cells to energize ones environment when the lights go out; fuel cells convert fuel into electricity without combustion, the use of scandium in technology such as Bloom Energy can drop the running temperature making it more efficient.

When it comes to fuel cells we are truly at the beginning stages with minerals such as scandium and its importance, with Imperial Mining Group being the only hard rock high quality scandium around, this resource is the best thing to happen to North America.

The Low Down:

Scandium a Critical Rare Earth Mineral before 2020 was an amazing find, but the numbers Imperial Mining Group is putting out is making them a hard rock sustainable long term pure play, rare earth materials have found a much greater need to be mined locally for more reasons as well, the time for locally mined scandium is now!

Imperial Mining Group has partnered up with the Quebec Government “innovation et development Manicougan” to develop a sustainable supply of scandium and scandium-aluminum alloy products, the agreement when signed for the awarding of 100,700$ all these grants including the 245,355$ all this collaboration to support Imperial Mining Group to lock in an American scandium critical rare earth mineral industry; countries that do not have rare earth minerals, will not be able to compete!

Scandium is mostly produced from Russia and China, two countries that the USA are having issues (to put it lightly) with lately! China already stated in 2020 they would stop shipping out Rare Earth Minerals…Imagine relying on two countries that could choke off a supply chain leading to a shortage in creating super computers or quantum computing or allowing us to be competitive!

It must not happen, Rare Earth Minerals must be mined locally and shareholders need to learn the value of supporting this drive that Imperial Mining is undertaking, we can also expect their pilot plant up summer of 2022.

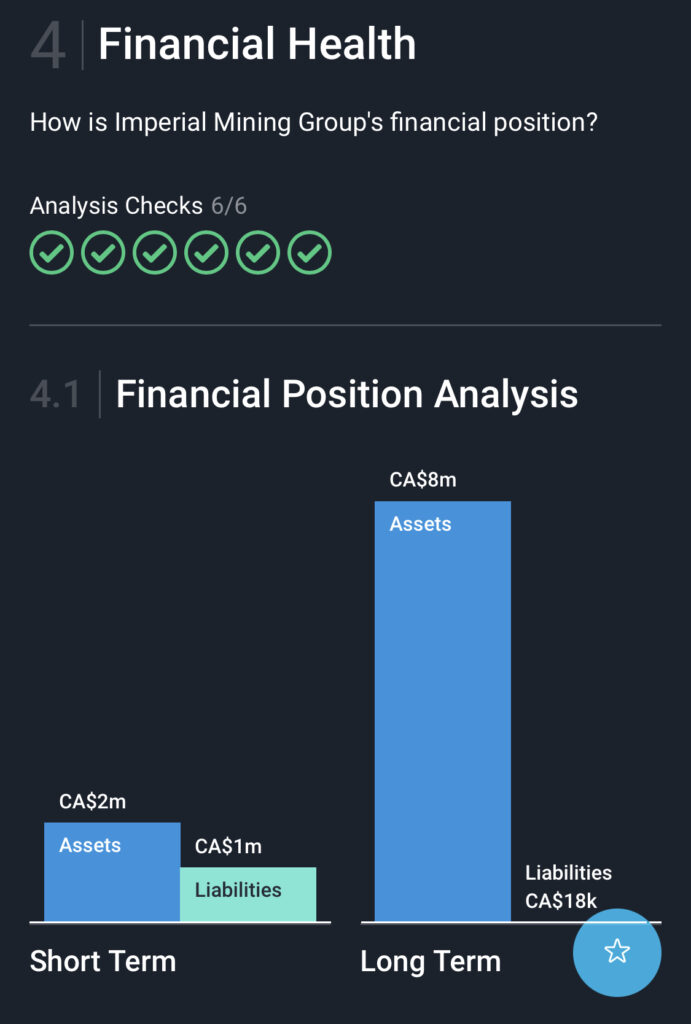

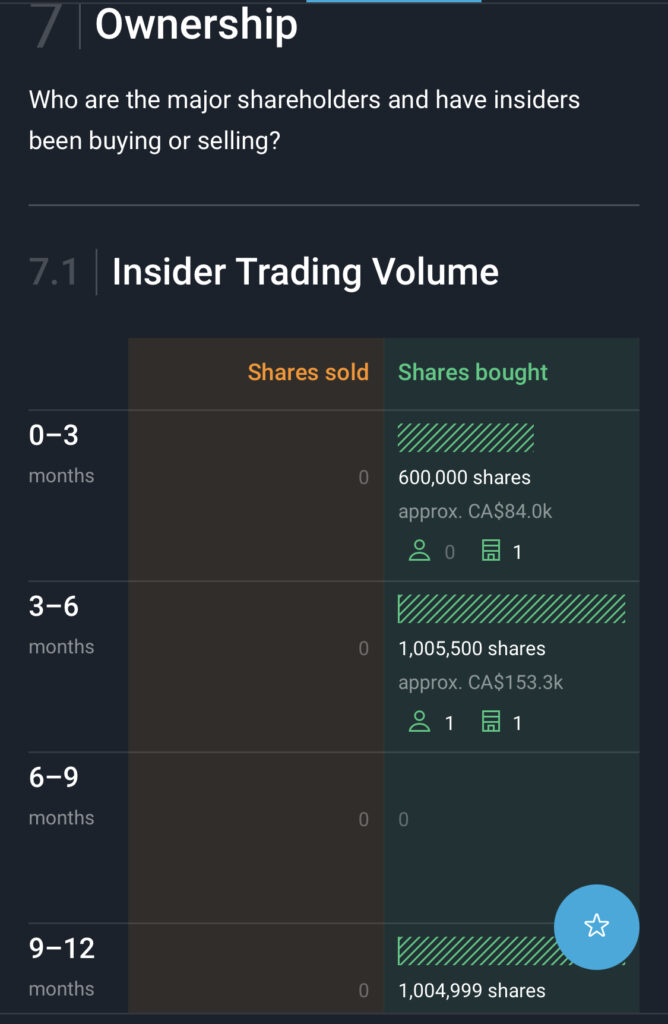

Imperial Mining Group has strong financials, a healthy breakdown of investors and we can see that in the last 12 months, there’s been active buying.

At the moment, Imperial Mining Group with its deposit is incredibly under evaluated, they should be up a few dollars, in time, the market will recognize and correct, the prices will shoot up as the deposit is very important and has high market worth, then add the ongoing tensions between the USA, Russia and China and continued sanctions, Imperial is strategically placed, the find of the scandium and in such quantities making it a pure play could not have come at a better time with a market cap of 21.9m, 162,57 shares outstanding a float of 137.44m, 15.81% shares held by insiders, 0.70% of shares held by institutions, with a stellar Management Team and Board of Directors, the time IMO (in my opinion) is to get in early and stock up on as many shares as possible because once they get to production, we should see a big increase in share price (information on Yahoo finance).

In Conclusion:

I’m extremely bullish when it comes to Imperial Mining Group, its hard rock, long term sustainable pure play scandium deposit with proper ESG to boot, unlike laterite claims which highly pollute, Imperial Mining Group also have room for expansion and we have not spoken about the other Critical Minerals they have such as Yttrium, Neod…here lets take the quote from an article linked here “In addition, detailed assessment of historical high-grade rare-earth niobium-tantalum occurrences, north and northwest of the Crater Lake Complex, known as the Crater Lake Extension property area (Figure 3), will be undertaken. In these areas, 2010 grab sampling results of up to 9.28% niobium oxide (Nb2O5), 13.4% zirconium (Zr), 2.4% total rare earths oxides plus yttrium (TREO+Y) and 3,020 ppm tantalum (Ta) were returned requiring further investigation.” Minerals on the critical mineral list included above for your convenience.

I like to put my money in winners as an investor it is very difficult not to have this company, Imperial Mining Group in your portfolio, as the west moves forward in securing its own Rare Earth Minerals!

HTTPS://BETWEENPLAYS.COM

Disclaimer: Betweenplays StockMarket Strategies owns stock in Imperial Mining Group and each individual should always do their research when investing. We are and entertainment education blog and the information in our blog posts is information readily available on the internet, through multiple sites including the webpage of the company in question. Investing in the stock market carries a significant amount of risk, one should seek the advise of a qualified financial advisor if help is needed, we are not responsible for any unrealized or realized loss as all companies are going concerns and every individual should follow every company they are invested in as daily informational changes may occur significantly impacting material changes.